Form St-125 - Farmer'S And Commercial Horse Boarding Operator'S Exemption Certificate

ADVERTISEMENT

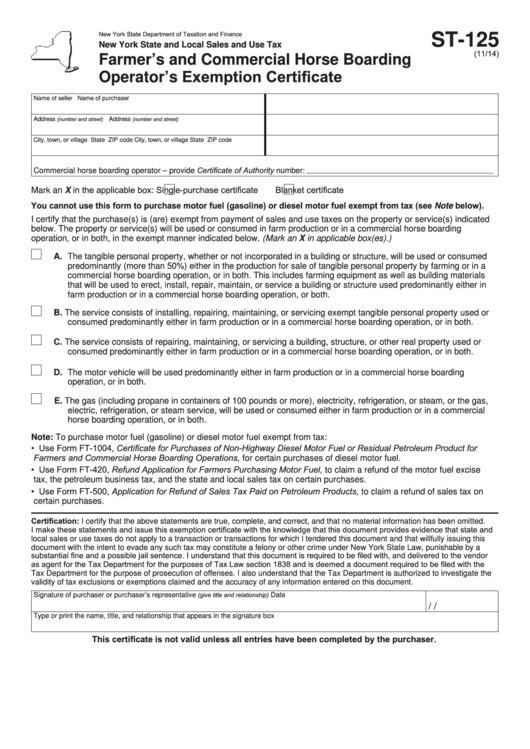

New York State Department of Taxation and Finance

ST-125

New York State and Local Sales and Use Tax

(11/14)

Farmer’s and Commercial Horse Boarding

Operator’s Exemption Certificate

Name of seller

Name of purchaser

(number and street)

(number and street)

Address

Address

City, town, or village

State

ZIP code

City, town, or village

State

ZIP code

Commercial horse boarding operator – provide Certificate of Authority number:

Single-purchase certificate

Blanket certificate

Mark an X in the applicable box:

You cannot use this form to purchase motor fuel (gasoline) or diesel motor fuel exempt from tax (see Note below).

I certify that the purchase(s) is (are) exempt from payment of sales and use taxes on the property or service(s) indicated

below. The property or service(s) will be used or consumed in farm production or in a commercial horse boarding

operation, or in both, in the exempt manner indicated below. (Mark an X in applicable box(es).)

A. The tangible personal property, whether or not incorporated in a building or structure, will be used or consumed

predominantly (more than 50%) either in the production for sale of tangible personal property by farming or in a

commercial horse boarding operation, or in both. This includes farming equipment as well as building materials

that will be used to erect, install, repair, maintain, or service a building or structure used predominantly either in

farm production or in a commercial horse boarding operation, or both.

B. The service consists of installing, repairing, maintaining, or servicing exempt tangible personal property used or

consumed predominantly either in farm production or in a commercial horse boarding operation, or in both.

C. The service consists of repairing, maintaining, or servicing a building, structure, or other real property used or

consumed predominantly either in farm production or in a commercial horse boarding operation, or in both.

D. The motor vehicle will be used predominantly either in farm production or in a commercial horse boarding

operation, or in both.

E. The gas (including propane in containers of 100 pounds or more), electricity, refrigeration, or steam, or the gas,

electric, refrigeration, or steam service, will be used or consumed either in farm production or in a commercial

horse boarding operation, or in both.

Note: To purchase motor fuel (gasoline) or diesel motor fuel exempt from tax:

• Use Form FT-1004, Certificate for Purchases of Non-Highway Diesel Motor Fuel or Residual Petroleum Product for

Farmers and Commercial Horse Boarding Operations, for certain purchases of diesel motor fuel.

• Use Form FT-420, Refund Application for Farmers Purchasing Motor Fuel, to claim a refund of the motor fuel excise

tax, the petroleum business tax, and the state and local sales tax on certain purchases.

• Use Form FT-500, Application for Refund of Sales Tax Paid on Petroleum Products, to claim a refund of sales tax on

certain purchases.

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted.

I make these statements and issue this exemption certificate with the knowledge that this document provides evidence that state and

local sales or use taxes do not apply to a transaction or transactions for which I tendered this document and that willfully issuing this

document with the intent to evade any such tax may constitute a felony or other crime under New York State Law, punishable by a

substantial fine and a possible jail sentence. I understand that this document is required to be filed with, and delivered to the vendor

as agent for the Tax Department for the purposes of Tax Law section 1838 and is deemed a document required to be filed with the

Tax Department for the purpose of prosecution of offenses. I also understand that the Tax Department is authorized to investigate the

validity of tax exclusions or exemptions claimed and the accuracy of any information entered on this document.

(give title and relationship)

Signature of purchaser or purchaser’s representative

Date

/

/

Type or print the name, title, and relationship that appears in the signature box

This certificate is not valid unless all entries have been completed by the purchaser.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2