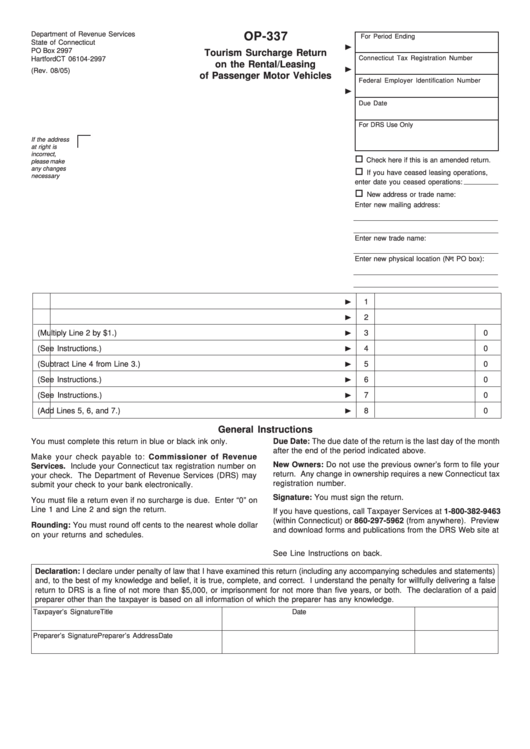

Department of Revenue Services

OP-337

For Period Ending

State of Connecticut

PO Box 2997

Tourism Surcharge Return

Connecticut Tax Registration Number

Hartford CT 06104-2997

on the Rental/Leasing

(Rev. 08/05)

of Passenger Motor Vehicles

Federal Employer Identification Number

Due Date

For DRS Use Only

If the address

at right is

incorrect,

Check here if this is an amended return.

please make

any changes

If you have ceased leasing operations,

necessary

enter date you ceased operations:

New address or trade name:

Enter new mailing address:

Enter new trade name:

Enter new physical location (Not PO box):

1.

Number of passenger motor vehicles subject to surcharge

1

2.

Total number of days the vehicles from Line 1 were rented or leased

2

3.

Amount of surcharge due (Multiply Line 2 by $1.)

3

00

4.

Credit for uncollectible accounts (See Instructions.)

4

00

5.

Net surcharge due (Subtract Line 4 from Line 3.)

5

00

6.

Penalty (See Instructions.)

6

00

7.

Interest (See Instructions.)

7

00

8.

Total amount due (Add Lines 5, 6, and 7.)

8

00

General Instructions

You must complete this return in blue or black ink only.

Due Date: The due date of the return is the last day of the month

after the end of the period indicated above.

Make your check payable to: Commissioner of Revenue

New Owners: Do not use the previous owner’s form to file your

Services. Include your Connecticut tax registration number on

return. Any change in ownership requires a new Connecticut tax

your check. The Department of Revenue Services (DRS) may

registration number.

submit your check to your bank electronically.

Signature: You must sign the return.

You must file a return even if no surcharge is due. Enter “0” on

Line 1 and Line 2 and sign the return.

If you have questions, call Taxpayer Services at 1-800-382-9463

(within Connecticut) or 860-297-5962 (from anywhere). Preview

Rounding: You must round off cents to the nearest whole dollar

and download forms and publications from the DRS Web site at

on your returns and schedules.

See Line Instructions on back.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements)

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false

return to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid

preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Taxpayer’s Signature

Title

Date

Preparer’s Signature

Preparer’s Address

Date

1

1 2

2