Form St-101.7 - Annual Schedule H - Report Of Clothing And Footwear Sales Eligible For Exemption - 2015

ADVERTISEMENT

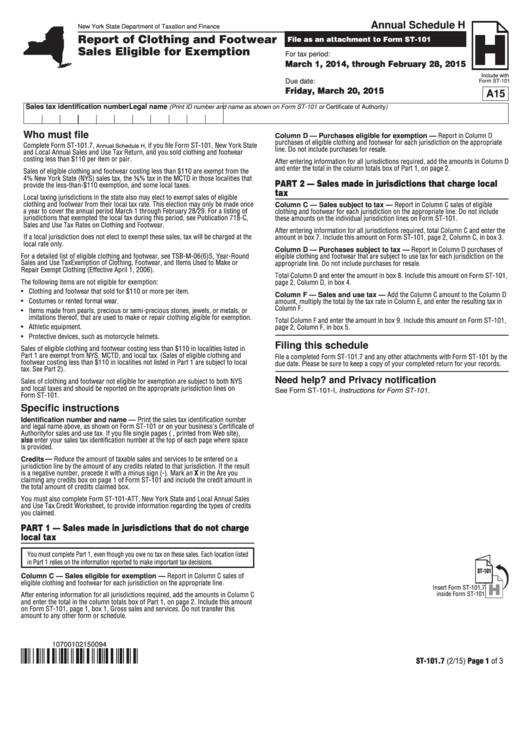

Annual Schedule H

New York State Department of Taxation and Finance

Report of Clothing and Footwear

File as an attachment to Form ST-101

Sales Eligible for Exemption

For tax period:

March 1, 2014, through February 28, 2015

Include with

Due date:

Form ST-101

Friday, March 20, 2015

A15

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-101 or Certificate of Authority)

Who must file

Column D — Purchases eligible for exemption — Report in Column D

purchases of eligible clothing and footwear for each jurisdiction on the appropriate

Complete Form ST-101.7, Annual Schedule H, if you file Form ST-101, New York State

line. Do not include purchases for resale.

and Local Annual Sales and Use Tax Return, and you sold clothing and footwear

costing less than $110 per item or pair.

After entering information for all jurisdictions required, add the amounts in Column D

and enter the total in the column totals box of Part 1, on page 2.

Sales of eligible clothing and footwear costing less than $110 are exempt from the

4% New York State (NYS) sales tax, the ⅜% tax in the MCTD in those localities that

PART 2 — Sales made in jurisdictions that charge local

provide the less-than-$110 exemption, and some local taxes.

tax

Local taxing jurisdictions in the state also may elect to exempt sales of eligible

clothing and footwear from their local tax rate. This election may only be made once

Column C — Sales subject to tax — Report in Column C sales of eligible

a year to cover the annual period March 1 through February 28/29. For a listing of

clothing and footwear for each jurisdiction on the appropriate line. Do not include

jurisdictions that exempted the local tax during this period, see Publication 718-C,

these amounts on the individual jurisdiction lines on Form ST-101.

Sales and Use Tax Rates on Clothing and Footwear.

After entering information for all jurisdictions required, total Column C and enter the

If a local jurisdiction does not elect to exempt these sales, tax will be charged at the

amount in box 7. Include this amount on Form ST-101, page 2, Column C, in box 3.

local rate only.

Column D — Purchases subject to tax — Report in Column D purchases of

For a detailed list of eligible clothing and footwear, see TSB-M-06(6)S, Year-Round

eligible clothing and footwear that are subject to use tax for each jurisdiction on the

Sales and Use Tax Exemption of Clothing, Footwear, and Items Used to Make or

appropriate line. Do not include purchases for resale.

Repair Exempt Clothing (Effective April 1, 2006).

Total Column D and enter the amount in box 8. Include this amount on Form ST-101,

The following items are not eligible for exemption:

page 2, Column D, in box 4.

• Clothing and footwear that sold for $110 or more per item.

Column F — Sales and use tax — Add the Column C amount to the Column D

• Costumes or rented formal wear.

amount, multiply the total by the tax rate in Column E, and enter the resulting tax in

Column F.

• Items made from pearls, precious or semi-precious stones, jewels, or metals, or

imitations thereof, that are used to make or repair clothing eligible for exemption.

Total Column F and enter the amount in box 9. Include this amount on Form ST-101,

• Athletic equipment.

page 2, Column F, in box 5.

• Protective devices, such as motorcycle helmets.

Filing this schedule

Sales of eligible clothing and footwear costing less than $110 in localities listed in

Part 1 are exempt from NYS, MCTD, and local tax. (Sales of eligible clothing and

File a completed Form ST-101.7 and any other attachments with Form ST-101 by the

footwear costing less than $110 in localities not listed in Part 1 are subject to local

due date. Please be sure to keep a copy of your completed return for your records.

tax. See Part 2).

Need help? and Privacy notification

Sales of clothing and footwear not eligible for exemption are subject to both NYS

and local taxes and should be reported on the appropriate jurisdiction lines on

See Form ST-101-I, Instructions for Form ST-101.

Form ST-101.

Specific instructions

Identification number and name — Print the sales tax identification number

and legal name above, as shown on Form ST-101 or on your business’s Certificate of

Authority for sales and use tax. If you file single pages (e.g., printed from Web site),

also enter your sales tax identification number at the top of each page where space

is provided.

Credits — Reduce the amount of taxable sales and services to be entered on a

jurisdiction line by the amount of any credits related to that jurisdiction. If the result

is a negative number, precede it with a minus sign (-). Mark an X in the Are you

claiming any credits box on page 1 of Form ST-101 and include the credit amount in

the total amount of credits claimed box.

You must also complete Form ST-101-ATT, New York State and Local Annual Sales

and Use Tax Credit Worksheet, to provide information regarding the types of credits

you claimed.

PART 1 — Sales made in jurisdictions that do not charge

local tax

You must complete Part 1, even though you owe no tax on these sales. Each location listed

in Part 1 relies on the information reported to make important tax decisions.

ST-101

Column C — Sales eligible for exemption — Report in Column C sales of

eligible clothing and footwear for each jurisdiction on the appropriate line.

H

Insert Form ST-101.7

inside Form ST-101

After entering information for all jurisdictions required, add the amounts in Column C

and enter the total in the column totals box of Part 1, on page 2. Include this amount

on Form ST-101, page 1, box 1, Gross sales and services. Do not transfer this

amount to any other form or schedule.

10700102150094

ST-101.7 (2/15) Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3