Department of Revenue Services

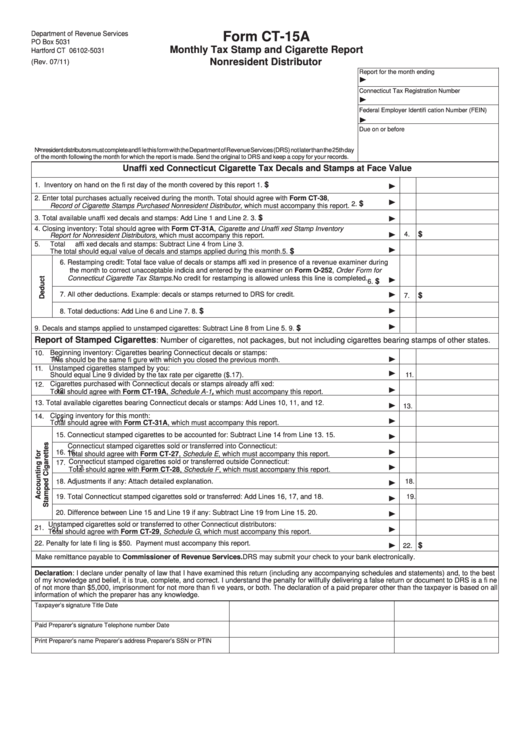

Form CT-15A

PO Box 5031

Monthly Tax Stamp and Cigarette Report

Hartford CT 06102-5031

Nonresident Distributor

(Rev. 07/11)

Report for the month ending

Connecticut Tax Registration Number

Federal Employer Identifi cation Number (FEIN)

Due on or before

Nonresident distributors must complete and fi le this form with the Department of Revenue Services (DRS) not later than the 25th day

of the month following the month for which the report is made. Send the original to DRS and keep a copy for your records

.

Unaffi xed Connecticut Cigarette Tax Decals and Stamps at Face Value

$

1.

Inventory on hand on the fi rst day of the month covered by this report

1.

2.

Enter total purchases actually received during the month. Total should agree with Form CT-38,

$

2.

Record of Cigarette Stamps Purchased Nonresident Distributor, which must accompany this report.

$

3.

Total available unaffi xed decals and stamps: Add Line 1 and Line 2.

3.

4.

Closing inventory: Total should agree with Form CT-31A, Cigarette and Unaffi xed Stamp Inventory

$

4.

Report for Nonresident Distributors, which must accompany this report.

5.

Total affi xed decals and stamps: Subtract Line 4 from Line 3.

$

The total should equal value of decals and stamps applied during this month.

5.

6. Restamping credit: Total face value of decals or stamps affi xed in presence of a revenue examiner during

the month to correct unacceptable indicia and entered by the examiner on Form O-252, Order Form for

Connecticut Cigarette Tax Stamps. No credit for restamping is allowed unless this line is completed.

$

6.

7. All other deductions. Example: decals or stamps returned to DRS for credit.

$

7.

$

8. Total deductions: Add Line 6 and Line 7.

8.

$

9.

Decals and stamps applied to unstamped cigarettes: Subtract Line 8 from Line 5.

9.

Report of Stamped Cigarettes

: Number of cigarettes, not packages, but not including cigarettes bearing stamps of other states.

Beginning inventory: Cigarettes bearing Connecticut decals or stamps:

10.

10.

This should be the same fi gure with which you closed the previous month.

11. Unstamped cigarettes stamped by you:

Should equal Line 9 divided by the tax rate per cigarette ($.17).

11.

Cigarettes purchased with Connecticut decals or stamps already affi xed:

12.

12.

Total should agree with Form CT-19A, Schedule A-1, which must accompany this report.

13. Total available cigarettes bearing Connecticut decals or stamps: Add Lines 10, 11, and 12.

13.

Closing inventory for this month:

14.

14.

Total should agree with Form CT-31A, which must accompany this report.

15. Connecticut stamped cigarettes to be accounted for: Subtract Line 14 from Line 13.

15.

Connecticut stamped cigarettes sold or transferred into Connecticut:

16.

16.

Total should agree with Fo rm CT-27, Schedule E, which must accompany this report.

Connecticut stamped cigarettes sold or transferred outside Connecticut:

17.

17.

Total should agree with Form CT-28, Schedule F, which must accompany this report.

1 8. Adjustments if any: Attach detailed explanation.

18.

19. Total Connecticut stamped cigarettes sold or transferred: Add Lines 16, 17, and 18.

19.

20. Difference between Line 15 and Line 19 if any: Subtract Line 19 from Line 15.

20.

Unstamped cigarettes sold or transferred to other Connecticut distributors:

21.

21.

Total should agree with Form CT-29, Schedule G, which must accompany this report.

22. Penalty for late fi ling is $50. Payment must accompany this report.

$

22.

Make remittance payable to Commissioner of Revenue Services. DRS may submit your check to your bank electronically.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best

of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fi ne

of not more than $5,000, imprisonment for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all

information of which the preparer has any knowledge.

Taxpayer’s signature

Title

Date

Paid Preparer’s signature

Telephone number

Date

Print Preparer’s name

Preparer’s address

Preparer’s SSN or PTIN

1

1 2

2