Form St-100.7 - Quarterly Schedule H - Report Of Clothing And Footwear Sales Eligible For Exemption

ADVERTISEMENT

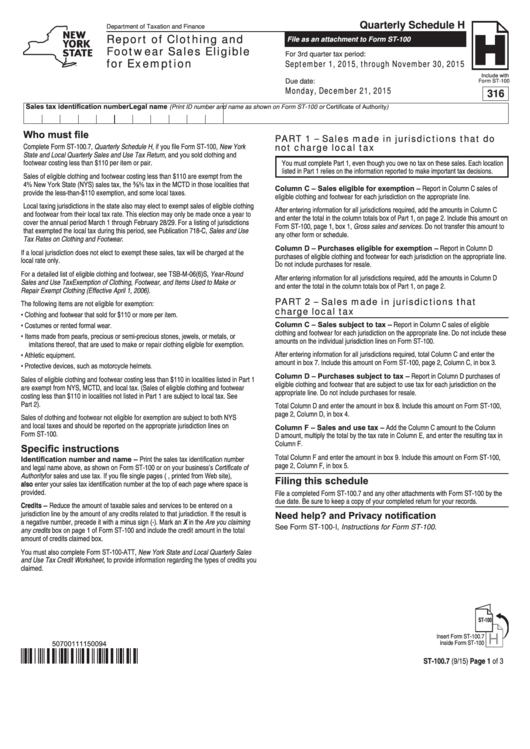

Quarterly Schedule H

Department of Taxation and Finance

Report of Clothing and

File as an attachment to Form ST-100

Footwear Sales Eligible

For 3rd quarter tax period:

for Exemption

September 1, 2015, through November 30, 2015

Include with

Due date:

Form ST-100

Monday, December 21, 2015

316

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-100 or Certificate of Authority)

Who must file

PART 1 – Sales made in jurisdictions that do

Complete Form ST-100.7, Quarterly Schedule H, if you file Form ST-100, New York

not charge local tax

State and Local Quarterly Sales and Use Tax Return, and you sold clothing and

footwear costing less than $110 per item or pair.

You must complete Part 1, even though you owe no tax on these sales. Each location

listed in Part 1 relies on the information reported to make important tax decisions.

Sales of eligible clothing and footwear costing less than $110 are exempt from the

4% New York State (NYS) sales tax, the ⅜% tax in the MCTD in those localities that

Column C – Sales eligible for exemption – Report in Column C sales of

provide the less-than-$110 exemption, and some local taxes.

eligible clothing and footwear for each jurisdiction on the appropriate line.

Local taxing jurisdictions in the state also may elect to exempt sales of eligible clothing

After entering information for all jurisdictions required, add the amounts in Column C

and footwear from their local tax rate. This election may only be made once a year to

and enter the total in the column totals box of Part 1, on page 2. Include this amount on

cover the annual period March 1 through February 28/29. For a listing of jurisdictions

Form ST-100, page 1, box 1, Gross sales and services. Do not transfer this amount to

that exempted the local tax during this period, see Publication 718-C, Sales and Use

any other form or schedule.

Tax Rates on Clothing and Footwear.

Column D – Purchases eligible for exemption – Report in Column D

If a local jurisdiction does not elect to exempt these sales, tax will be charged at the

purchases of eligible clothing and footwear for each jurisdiction on the appropriate line.

local rate only.

Do not include purchases for resale.

For a detailed list of eligible clothing and footwear, see TSB-M-06(6)S, Year-Round

After entering information for all jurisdictions required, add the amounts in Column D

Sales and Use Tax Exemption of Clothing, Footwear, and Items Used to Make or

and enter the total in the column totals box of Part 1, on page 2.

Repair Exempt Clothing (Effective April 1, 2006).

PART 2 – Sales made in jurisdictions that

The following items are not eligible for exemption:

charge local tax

• Clothing and footwear that sold for $110 or more per item.

Column C – Sales subject to tax – Report in Column C sales of eligible

• Costumes or rented formal wear.

clothing and footwear for each jurisdiction on the appropriate line. Do not include these

• Items made from pearls, precious or semi-precious stones, jewels, or metals, or

amounts on the individual jurisdiction lines on Form ST-100.

imitations thereof, that are used to make or repair clothing eligible for exemption.

After entering information for all jurisdictions required, total Column C and enter the

• Athletic equipment.

amount in box 7. Include this amount on Form ST-100, page 2, Column C, in box 3.

• Protective devices, such as motorcycle helmets.

Column D – Purchases subject to tax – Report in Column D purchases of

Sales of eligible clothing and footwear costing less than $110 in localities listed in Part 1

eligible clothing and footwear that are subject to use tax for each jurisdiction on the

are exempt from NYS, MCTD, and local tax. (Sales of eligible clothing and footwear

appropriate line. Do not include purchases for resale.

costing less than $110 in localities not listed in Part 1 are subject to local tax. See

Part 2).

Total Column D and enter the amount in box 8. Include this amount on Form ST-100,

page 2, Column D, in box 4.

Sales of clothing and footwear not eligible for exemption are subject to both NYS

and local taxes and should be reported on the appropriate jurisdiction lines on

Column F – Sales and use tax – Add the Column C amount to the Column

Form ST-100.

D amount, multiply the total by the tax rate in Column E, and enter the resulting tax in

Column F.

Specific instructions

Total Column F and enter the amount in box 9. Include this amount on Form ST-100,

Identification number and name – Print the sales tax identification number

page 2, Column F, in box 5.

and legal name above, as shown on Form ST-100 or on your business’s Certificate of

Authority for sales and use tax. If you file single pages (e.g., printed from Web site),

Filing this schedule

also enter your sales tax identification number at the top of each page where space is

provided.

File a completed Form ST-100.7 and any other attachments with Form ST-100 by the

due date. Be sure to keep a copy of your completed return for your records.

Credits – Reduce the amount of taxable sales and services to be entered on a

jurisdiction line by the amount of any credits related to that jurisdiction. If the result is

Need help? and Privacy notification

a negative number, precede it with a minus sign (-). Mark an X in the Are you claiming

See Form ST-100-I, Instructions for Form ST-100.

any credits box on page 1 of Form ST-100 and include the credit amount in the total

amount of credits claimed box.

You must also complete Form ST-100-ATT, New York State and Local Quarterly Sales

and Use Tax Credit Worksheet, to provide information regarding the types of credits you

claimed.

ST-100

H

Insert Form ST-100.7

inside Form ST-100

50700111150094

ST-100.7 (9/15) Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3