Instructions For Arizona Form 201- Renter'S Certificate Of Property Taxes Paid

ADVERTISEMENT

Arizona Form

Renter's Certificate of Property Taxes Paid

201

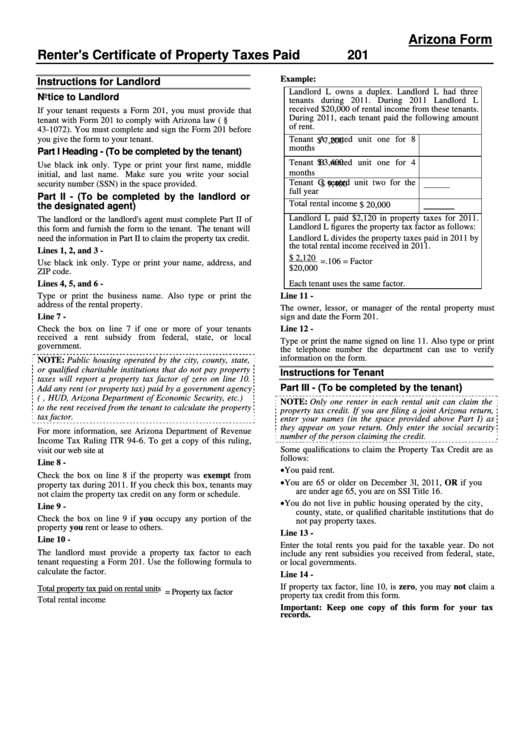

Example:

Instructions for Landlord

Landlord L owns a duplex. Landlord L had three

Notice to Landlord

tenants during 2011. During 2011 Landlord L

received $20,000 of rental income from these tenants.

If your tenant requests a Form 201, you must provide that

During 2011, each tenant paid the following amount

tenant with Form 201 to comply with Arizona law (A.R.S. §

of rent.

43-1072). You must complete and sign the Form 201 before

you give the form to your tenant.

Tenant A rented unit one for 8

$ 7,200

months

Part I Heading - (To be completed by the tenant)

Tenant B rented unit one for 4

$ 3,400

Use black ink only. Type or print your first name, middle

months

initial, and last name. Make sure you write your social

Tenant C rented unit two for the

security number (SSN) in the space provided.

$ 9,400

full year

Part II - (To be completed by the landlord or

Total rental income

$ 20,000

the designated agent)

Landlord L paid $2,120 in property taxes for 2011.

The landlord or the landlord's agent must complete Part II of

Landlord L figures the property tax factor as follows:

this form and furnish the form to the tenant. The tenant will

Landlord L divides the property taxes paid in 2011 by

need the information in Part II to claim the property tax credit.

the total rental income received in 2011.

Lines 1, 2, and 3 -

$ 2,120 =.106 = Factor

Use black ink only. Type or print your name, address, and

$20,000

ZIP code.

Lines 4, 5, and 6 -

Each tenant uses the same factor.

Type or print the business name. Also type or print the

Line 11 -

address of the rental property.

The owner, lessor, or manager of the rental property must

Line 7 -

sign and date the Form 201.

Check the box on line 7 if one or more of your tenants

Line 12 -

received a rent subsidy from federal, state, or local

Type or print the name signed on line 11. Also type or print

government.

the telephone number the department can use to verify

information on the form.

NOTE: Public housing operated by the city, county, state,

or qualified charitable institutions that do not pay property

Instructions for Tenant

taxes will report a property tax factor of zero on line 10.

)

Part III - (To be completed by the tenant

Add any rent (or property tax) paid by a government agency

(i.e., HUD, Arizona Department of Economic Security, etc.)

NOTE: Only one renter in each rental unit can claim the

to the rent received from the tenant to calculate the property

property tax credit. If you are filing a joint Arizona return,

tax factor.

enter your names (in the space provided above Part I) as

they appear on your return. Only enter the social security

For more information, see Arizona Department of Revenue

number of the person claiming the credit.

Income Tax Ruling ITR 94-6. To get a copy of this ruling,

Some qualifications to claim the Property Tax Credit are as

visit our web site at

follows:

Line 8 -

You paid rent.

Check the box on line 8 if the property was exempt from

You are 65 or older on December 3l, 2011, OR if you

property tax during 2011. If you check this box, tenants may

are under age 65, you are on SSI Title 16.

not claim the property tax credit on any form or schedule.

You do not live in public housing operated by the city,

Line 9 -

county, state, or qualified charitable institutions that do

Check the box on line 9 if you occupy any portion of the

not pay property taxes.

property you rent or lease to others.

Line 13 -

Line 10 -

Enter the total rents you paid for the taxable year. Do not

The landlord must provide a property tax factor to each

include any rent subsidies you received from federal, state,

tenant requesting a Form 201. Use the following formula to

or local governments.

calculate the factor.

Line 14 -

If property tax factor, line 10, is zero, you may not claim a

Total property tax paid on rental units = Property tax factor

property tax credit from this form.

Total rental income

Important: Keep one copy of this form for your tax

records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1