Form Ct-1120 Esa - Estimated Corporation Business Tax - 2012 Page 2

ADVERTISEMENT

Who must fi le: Every corporation carrying on business or having the right to carry on business in Connecticut whose estimated current year tax liability, as shown

on Schedule 1, Line 4, is more than $1,000.

Combined or unitary returns: If fi ling a combined or

Interest: If the current year tax is more than $1,000

underpaid installments in the order in which the

unitary return for an affi liated group of corporations,

and the estimated payment does not equal: (1) 27%

installments are required to be paid.

check the applicable box on the front of this form and

of the current year tax; or (2) 30% of the tax shown

Annualization: If a corporation establishes that its

attach a list of the names and tax registration numbers

on the prior year return (without regard to any tax

annualized income installment is less than Schedule 1,

of those corporations. Enter the total combined or

credits), whichever is less, interest is assessed at 1%

Line 5, then the corporation must enter the amount

unitary estimated current year tax including preference

per month or fraction of a month on the amount of the

from Worksheet CT-1120AE, Line 20, Column A,

tax and surtax on Schedule 1, Line 1.

underpayment for the period of the underpayment.

onto Schedule 1, Line 5, for this installment. See

If a company uses an estimate of its current year

Limit on credits: The amount of tax credits otherwise

Informational Publication 2011(21), Q & A on

tax to determine the required annual payment and

allowable against the corporation business tax for any

Estimated Corporation Business Tax and Worksheet

the amount changes during the year, it may fi nd that

income year generally shall not exceed 70% of the

CT-1120AE.

earlier installments of estimated tax were underpaid.

amount of tax due prior to the application of tax credits.

Payments of estimated tax are credited fi rst against

See Form CT-1120 TCE, Tax Credit Cap Expansion.

Visit DRS website at to fi le and pay this return electronically.

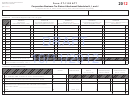

Schedule 1

00

1. Estimated current year tax (including surtax) before applying corporation business tax credits

1.

00

2. Multiply Line 1 by 70% (.70) and add the amount from Form CT-1120 TCE, Line 16, if applicable.

2.

00

3. Estimated corporation business tax credits: Do not exceed amount on Line 2.

3.

00

4. Subtotal: Subtract Line 3 from Line 1.

4.

Current year fi rst installment: Multiply Line 4 by 27% (.27) or enter the amount from Worksheet CT-1120AE,

5.

00

5.

Line 20, Column A .

CT-1120 ESA Back (Rev. 01/12)

Who must fi le: Every corporation carrying on business or having the right to carry on business in Connecticut whose estimated current year tax liability, as shown

on Schedule 1, Line 4, is more than $1,000.

Combined or unitary returns: If fi ling a combined or

Interest: If the current year tax is more than $1,000

underpaid installments in the order in which the

unitary return for an affi liated group of corporations,

and the estimated payment does not equal: (1) 63%

installments are required to be paid.

check the applicable box on the front of this form and

of the current year tax; or (2) 70% of the tax shown

Annualization: If a corporation establishes that its

attach a list of the names and tax registration numbers

on the prior year return (without regard to any tax

annualized income installment is less than Schedule 1,

of those corporations. Enter the total combined or

credits), whichever is less, interest is assessed at 1%

Line 5, then the corporation must enter the amount

unitary estimated current year tax including preference

per month or fraction of a month on the amount of the

from Worksheet CT-1120AE, Line 20, Column B,

tax and surtax on Schedule 1, Line 1.

underpayment for the period of the underpayment.

onto Schedule 1, Line 5, for this installment. See

If a company uses an estimate of its current year

Limit on credits: The amount of tax credits otherwise

Informational Publication 2011(21), Q & A on

tax to determine the required annual payment and

allowable against the corporation business tax for any

Estimated Corporation Business Tax and Worksheet

the amount changes during the year, it may fi nd that

income year generally shall not exceed 70% of the

CT-1120AE.

earlier installments of estimated tax were underpaid.

amount of tax due prior to the application of tax credits.

Payments of estimated tax are credited fi rst against

See Form CT-1120 TCE, Tax Credit Cap Expansion.

Visit the DRS website at to fi le and pay this return electronically.

Schedule 1

00

1. Estimated current year tax (including surtax) before applying corporation business tax credits

1.

00

2. Multiply Line 1 by 70% (.70) and add the amount from Form CT-1120 TCE, Line 16, if applicable.

2.

00

3. Estimated corporation business tax credits: Do not exceed amount on Line 2.

3.

00

4. Subtotal: Subtract Line 3 from Line 1.

4.

5. Current year second installment: Multiply Line 4 by 63% (.63) or enter the amount from Worksheet CT-1120AE,

5.

00

Line 20, Column B.

CT-1120 ESB Back (Rev. 01/12)

Who must fi le: Every corporation carrying on business or having the right to carry on business in Connecticut whose estimated current year tax liability, as shown

on Schedule 1, Line 4, is more than $1,000.

Combined or unitary returns: If fi ling a combined or

Interest: If the current year tax is more than $1,000

underpaid installments in the order in which the

unitary return for an affi liated group of corporations,

and the estimated payment does not equal: (1) 72%

installments are required to be paid.

check the applicable box on the front of this form and

of the current year tax; or (2) 80% of the tax shown

Annualization: If a corporation establishes that its

attach a list of the names and tax registration numbers

on the prior year return (without regard to any tax

annualized income installment is less than Schedule 1,

of those corporations. Enter the total combined or

credits), whichever is less, interest is assessed at 1%

Line 5, then the corporation must enter the amount

unitary estimated current year tax including preference

per month or fraction of a month on the amount of the

from Worksheet CT-1120AE, Line 20, Column C,

tax and surtax on Schedule 1, Line 1.

underpayment for the period of the underpayment.

onto Schedule 1, Line 5, for this installment. See

If a company uses an estimate of its current year

Limit on credits: The amount of tax credits otherwise

Informational Publication 2011(21), Q & A on

tax to determine the required annual payment and

allowable against the corporation business tax for any

Estimated Corporation Business Tax and Worksheet

the amount changes during the year, it may fi nd that

income year generally shall not exceed 70% of the

CT-1120AE.

earlier installments of estimated tax were underpaid.

amount of tax due prior to the application of tax credits.

Payments of estimated tax are credited fi rst against

See Form CT-1120 TCE, Tax Credit Cap Expansion.

Schedule 1

Visit the DRS website at to fi le and pay this return electronically.

00

1. Estimated current year tax (including surtax) before applying corporation business tax credits

1.

00

2. Multiply Line 1 by 70% (.70) and add the amount from Form CT-1120 TCE, Line 16, if applicable.

2.

00

3. Estimated corporation business tax credits: Do not exceed amount on Line 2.

3.

00

4. Subtotal: Subtract Line 3 from Line 1.

4.

5. Current year third installment: Multiply Line 4 by 72% (.72) or enter the amount from Worksheet CT-1120AE,

5 .

00

Line 20, Column C.

CT-1120 ESC Back (Rev. 01/12)

Who must fi le: Every corporation carrying on business or having the right to carry on business in Connecticut whose estimated current year tax liability, as shown

on Schedule 1, Line 4, is more than $1,000.

Combined or unitary returns: If fi ling a combined or

Interest: If the current year tax is more than $1,000

underpaid installments in the order in which the

unitary return for an affi liated group of corporations,

and the estimated payment does not equal: (1) 90%

installments are required to be paid.

check the applicable box on the front of this form and

of the current year tax; or (2) 100% of the tax shown

Annualization: If a corporation establishes that its

attach a list of the names and tax registration numbers

on the prior year return (without regard to any tax

annualized income installment is less than Schedule 1,

of those corporations. Enter the total combined or

credits), whichever is less, interest is assessed at 1%

Line 5, then the corporation must enter the amount

unitary estimated current year tax including preference

per month or fraction of a month on the amount of the

from Worksheet CT-1120AE, Line 20, Column D,

tax and surtax on Schedule 1, Line 1.

underpayment for the period of the underpayment.

onto Schedule 1, Line 5, for this installment. See

If a company uses an estimate of its current year

Limit on credits: The amount of tax credits otherwise

Informational Publication 2011(21), Q & A on

tax to determine the required annual payment and

allowable against the corporation business tax for any

Estimated Corporation Business Tax and Worksheet

the amount changes during the year, it may fi nd that

income year generally shall not exceed 70% of the

CT-1120AE.

earlier installments of estimated tax were underpaid.

amount of tax due prior to the application of tax credits.

Payments of estimated tax are credited fi rst against

See Form CT-1120 TCE, Tax Credit Cap Expansion.

Schedule 1

Visit the DRS website at to fi le and pay this return electronically.

00

1. Estimated current year tax (including surtax) before applying corporation business tax credits

1.

00

2. Multiply Line 1 by 70% (.70) and add the amount from Form CT-1120 TCE, Line 16, if applicable.

2.

00

3. Estimated corporation business tax credits: Do not exceed amount on Line 2.

3.

00

4. Subtotal: Subtract Line 3 from Line 1.

4.

5. Current year fourth installment: Multiply Line 4 by 90% (.90) or enter the amount from Worksheet CT-1120AE,

5.

00

Line 20, Column D.

CT-1120 ESD Back (Rev. 01/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2