Instructions For Arizona Form 120x - Arizona Amended Corporation Income Tax Return - 2011 Page 4

ADVERTISEMENT

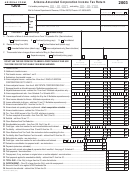

Arizona Form 120X

A taxpayer may not claim a tax credit on the 2011 tax return

Solar Liquid Fuel Credit. This tax credit is for

for a donation to the fund made with the 2011 tax return

taxpayers that increase research activities related to

(Form 120 or Form 120A). If a taxpayer makes a donation to

solar liquid fuel. Additional credits will become

the fund on the 2011 tax return, the taxpayer may only claim

available in 2016 for production and delivery system

a tax credit for the donation on the taxpayer’s 2012 tax

costs. Use Form 344 to claim this credit.

return. The tax credit is nonrefundable and the unused

Credit for New Employment. This tax credit is for

portion of the tax credit may not be carried forward.

taxpayers that have net increases in employment after

Calculation of 2011 Clean Elections Fund Tax Credit

June 30, 2011. The credit limit is administered by the

Enter the amount donated directly to the

Arizona Commerce Authority. Use Form 345 to claim

fund during the taxable year 2011 PLUS

$

00

1.

this credit.

the amount donated to the fund with the

2010 Form 120 or 2010 Form 120A.

Complete the appropriate credit form for each credit. Attach

$

00

2.

Enter tax from 2011 Form 120X, line 22(c).

the completed credit form(s) to Form 120X with Form 300,

3.

Multiply amount on line 2 by 20 percent (.20).

$

00

whether or not the amount claimed on line 20 has changed.

4.

$

670

00

Line 21 - Credit Type

$

00

5.

Enter the larger of line 3 or line 4.

Indicate which tax credits were claimed on line 20 by writing

Enter the smaller of line 1, line 2, or line 5

the applicable form number(s) in the space provided.

6.

$

00

here and on 2011 Form 120X, line 23(c).

Complete this line whether or not the amount of tax credits

claimed on line 20 has changed.

Line 25 - Refundable Tax Credits

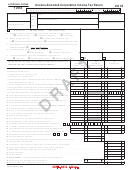

Nonrefundable Income Tax Credit

Form

Check the box marked 308 or 342 to indicate which of these

Defense Contracting Credits

302

tax credits the taxpayer is claiming. Enter the amount of the

Enterprise Zone Credit

304

credit claimed on line 25.

Environmental Technology Facility Credit

305

Military Reuse Zone Credit

306

Credit for Increased Research Activities. A portion of this

Credit for Increased Research Activities

308

tax credit is refundable for qualified taxpayers. The refund is

Pollution Control Credit

315

limited to 75% of the excess credit, which is the current

Credit for Taxes Paid for Coal Consumed in Generating

318

year's credit less the current year's tax liability, not to exceed

Electrical Power

Credit for Solar Hot Water Heater Plumbing Stub Outs

the amount approved by the Arizona Commerce Authority

319

and Electric Vehicle Recharge Outlets

(formerly, the Arizona Department of Commerce). The

Credit for Employment of TANF Recipients

320

refundable credit applies to taxable years beginning from and

Agricultural Pollution Control Equipment Credit

325

after December 31, 2009. Attach your "Certificate of

Credit for Donation of School Site

331

Qualification" from the Arizona Commerce Authority and

Credit for Healthy Forest Enterprises

332

Credit for Employing National Guard Members

333

Form 308 to your return. Enter the amount from Form 308,

Motion Picture Credits

334

Part V, line 39.

Credit for Corporate Contributions to School Tuition

335

Organizations

Credit for Renewable Energy Industry. This tax credit is

Credit for Solar Energy Devices - Commercial and Industrial

for expanding or locating qualified renewable energy

336

Applications

operations in Arizona and is refundable in five equal

Credit for Water Conservation System Plumbing Stub Outs

337

installments. Preapproval and postapproval are required

Credit for Corporate Contributions to School Tuition

Organizations for Displaced Students or Students With

341

through the Arizona Commerce Authority (formerly, the

Disabilities

Arizona Department of Commerce). Attach your "Certificate

Renewable Energy Production Tax Credit

343

of Qualification" from the Arizona Commerce Authority and

Solar Liquid Fuel Credit

344

Form 342 to your tax return to claim this credit. Enter the

Credit for New Employment

345

amount from Form 342, Part IV, line 12.

Line 23 - Clean Elections Fund Tax Credit

If you are claiming both tax credits, check both boxes and

A taxpayer may claim a tax credit on the 2011 tax return for:

add the amounts from the credit forms together and enter the

total on line 25.

A donation made directly to the Clean Elections Fund

during the taxable year 2011; and/or

Line 26 - Payments (Extension, Estimated)

A donation made to the Clean Elections Fund on the

Enter the total amount from the original return (2011 Form

taxpayer’s 2010 tax return.

120, lines 26 and 27; or 2011 Form 120A, lines 18 and 19).

The 2011 tax credit is equal to the amount of the donation(s),

Line 27 - Payment With Original Return (Plus All

but cannot exceed twenty percent of the tax liability on line

Additional Payments After It Was Filed)

22(c) or six hundred seventy dollars, whichever is higher.

Enter the amount from page 2, Schedule D, line 4.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7