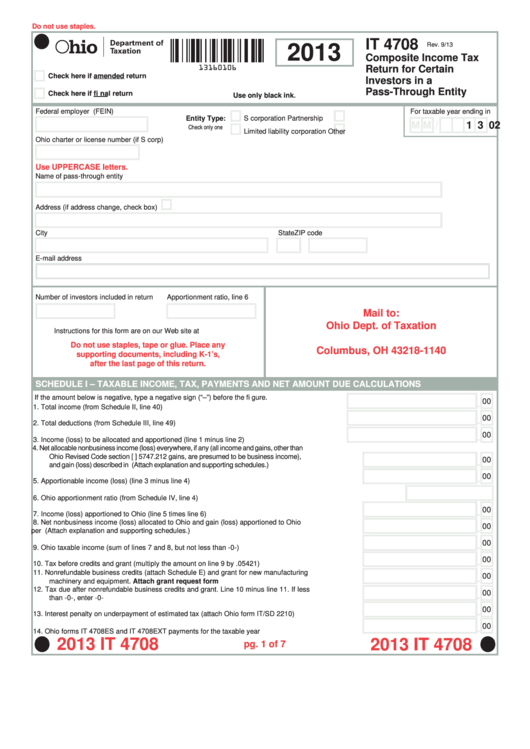

Reset Form

Do not use staples.

IT 4708

Rev. 9/13

2013

Composite Income Tax

13160106

Return for Certain

Check here if amended return

Investors in a

Pass-Through Entity

Check here if fi nal return

Use only black ink.

Federal employer I.D. number (FEIN)

For taxable year ending in

Entity Type:

S corporation

Partnership

/

M M

2

0

1 3

Check only one

Limited liability corporation

Other

Ohio charter or license number (if S corp)

Use UPPERCASE letters.

Name of pass-through entity

Address (if address change, check box)

City

State

ZIP code

E-mail address

Number of investors included in return

Apportionment ratio, line 6

Mail to:

Ohio Dept. of Taxation

Instructions for this form are on our Web site at tax.ohio.gov.

P.O. Box 181140

Do not use staples, tape or glue. Place any

Columbus, OH 43218-1140

supporting documents, including K-1’s,

after the last page of this return.

SCHEDULE I – TAXABLE INCOME, TAX, PAYMENTS AND NET AMOUNT DUE CALCULATIONS

If the amount below is negative, type a negative sign (“–”) before the fi gure.

00

.

1. Total income (from Schedule II, line 40)

.......................................................................................1.

00

.

2. Total deductions (from Schedule III, line 49)

................................................................................2.

00

.

............................................3.

3. Income (loss) to be allocated and apportioned (line 1 minus line 2)

4. Net allocable nonbusiness income (loss) everywhere, if any (all income and gains, other than

Ohio Revised Code section [R.C.] 5747.212 gains, are presumed to be business income),

.

00

and gain (loss) described in R.C. 5747.212. (Attach explanation and supporting schedules.)

.............4.

00

.

5. Apportionable income (loss) (line 3 minus line 4)

.........................................................................5.

.....................................................................6.

6. Ohio apportionment ratio (from Schedule IV, line 4)

00

.

7. Income (loss) apportioned to Ohio (line 5 times line 6)

................................................................7.

8. Net nonbusiness income (loss) allocated to Ohio and gain (loss) apportioned to Ohio

00

.

per R.C. 5747.212. (Attach explanation and supporting schedules.)

...........................................8.

00

.

...............................................9.

9. Ohio taxable income (sum of lines 7 and 8, but not less than -0-)

00

.

10. Tax before credits and grant (multiply the amount on line 9 by .05421)

.....................................10.

11. Nonrefundable business credits (attach Schedule E) and grant for new manufacturing

.

00

.............................................................11.

machinery and equipment. Attach grant request form

12. Tax due after nonrefundable business credits and grant. Line 10 minus line 11. If less

00

.

than -0-, enter -0-

........................................................................................................................12.

.

00

13. Interest penalty on underpayment of estimated tax (attach Ohio form IT/SD 2210)

..................13.

00

.

....................................14.

14. Ohio forms IT 4708ES and IT 4708EXT payments for the taxable year

2013 IT 4708

2013 IT 4708

pg. 1 of 7

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8