Reset

Print Form

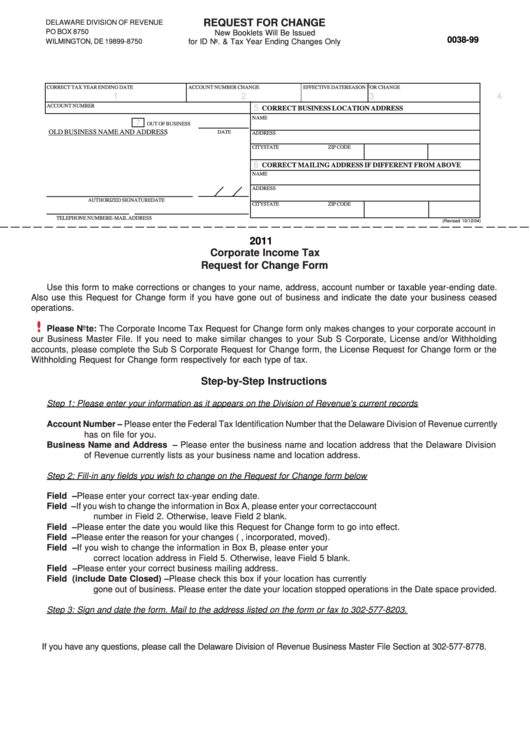

REQUEST FOR CHANGE

DELAWARE DIVISION OF REVENUE

PO BOX 8750

New Booklets Will Be Issued

0038-99

WILMINGTON, DE 19899-8750

for ID No. & Tax Year Ending Changes Only

003899090000000000000 12311100000000000000000000000000

CORRECT TAX YEAR ENDING DATE

ACCOUNT NUMBER CHANGE

EFFECTIVE DATE

REASON FOR CHANGE

1

2

3

4

ACCOUNT NUMBER

5

0-000000000-000

CORRECT BUSINESS LOCATION ADDRESS

NAME

7

OUT OF BUSINESS

OLD BUSINESS NAME AND ADDRESS

DATE

ADDRESS

CITY

STATE

ZIP CODE

6

CORRECT MAILING ADDRESS IF DIFFERENT FROM ABOVE

NAME

ADDRESS

AUTHORIZED SIGNATURE

DATE

CITY

STATE

ZIP CODE

TELEPHONE NUMBER

E-MAIL ADDRESS

(Revised 10/12/04)

2011

Corporate Income Tax

Request for Change Form

Use this form to make corrections or changes to your name, address, account number or taxable year-ending date.

Also use this Request for Change form if you have gone out of business and indicate the date your business ceased

operations.

Please Note: The Corporate Income Tax Request for Change form only makes changes to your corporate account in

our Business Master File. If you need to make similar changes to your Sub S Corporate, License and/or Withholding

accounts, please complete the Sub S Corporate Request for Change form, the License Request for Change form or the

Withholding Request for Change form respectively for each type of tax.

Step-by-Step Instructions

Step 1: Please enter your information as it appears on the Division of Revenue’s current records

Account Number – Please enter the Federal Tax Identification Number that the Delaware Division of Revenue currently

has on file for you.

Business Name and Address – Please enter the business name and location address that the Delaware Division

of Revenue currently lists as your business name and location address.

Step 2: Fill-in any fields you wish to change on the Request for Change form below

Field 1. Correct Tax Year Ending Date – Please enter your correct tax-year ending date.

Field 2. Account Number Change – If you wish to change the information in Box A, please enter your correctaccount

number in Field 2. Otherwise, leave Field 2 blank.

Field 3. Effective Date – Please enter the date you would like this Request for Change form to go into effect.

Field 4. Reason for Change – Please enter the reason for your changes (i.e. out of business, incorporated, moved).

Field 5. New Business Location Address – If you wish to change the information in Box B, please enter your

correct location address in Field 5. Otherwise, leave Field 5 blank.

Field 6. New Mailing Address – Please enter your correct business mailing address.

Field 7. Out of Business checkbox (include Date Closed) – Please check this box if your location has currently

gone out of business. Please enter the date your location stopped operations in the Date space provided.

Step 3: Sign and date the form. Mail to the address listed on the form or fax to 302-577-8203.

If you have any questions, please call the Delaware Division of Revenue Business Master File Section at 302-577-8778.

1

1