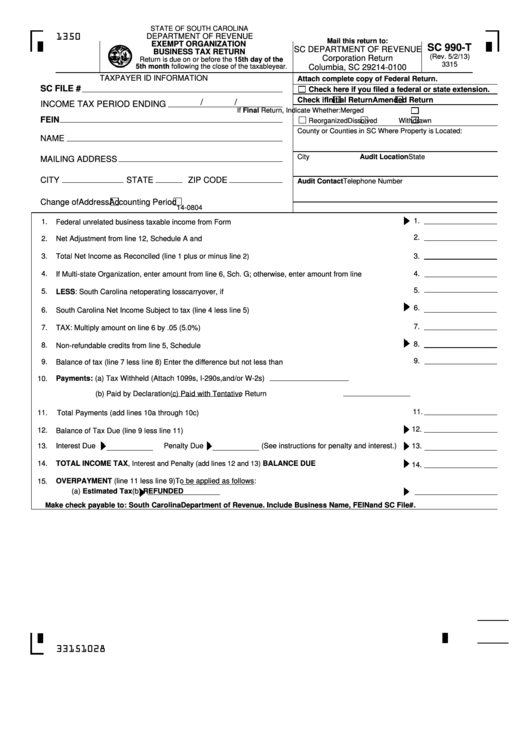

Form Sc 990-T - Exempt Organization Business Tax Return

ADVERTISEMENT

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

1350

Mail this return to:

EXEMPT ORGANIZATION

SC 990-T

SC DEPARTMENT OF REVENUE

BUSINESS TAX RETURN

(Rev. 5/2/13)

Corporation Return

Return is due on or before the 15th day of the

3315

5th month following the close of the taxable year.

Columbia, SC 29214-0100

TAXPAYER ID INFORMATION

Attach complete copy of Federal Return.

SC FILE #

Check here if you filed a federal or state extension.

Check if

Initial Return

Amended Return

/

/

INCOME TAX PERIOD ENDING

If Final Return, Indicate Whether:

Merged

FEIN

Reorganized

Dissolved

Withdrawn

County or Counties in SC Where Property is Located:

NAME

City

Audit Location

State

MAILING ADDRESS

CITY

STATE

ZIP CODE

Audit Contact

Telephone Number

Change of

Address

Accounting Period

14-0804

1.

1.

Federal unrelated business taxable income from Form 990T.......................................................................

2.

2.

Net Adjustment from line 12, Schedule A and B...........................................................................................

3.

3.

Total Net Income as Reconciled (line 1 plus or minus line

2)............................................................................

4.

4.

If Multi-state Organization, enter amount from line 6, Sch. G; otherwise, enter amount from line 3.............

5.

5.

LESS: South Carolina net operating loss carryover, if applicable................................................................

6.

6.

South Carolina Net Income Subject to tax (line 4 less line 5).......................................................................

7.

7.

TAX: Multiply amount on line 6 by .05 (5.0%)...............................................................................................

8.

8.

Non-refundable credits from line 5, Schedule C...........................................................................................

9.

9.

Balance of tax (line 7 less line 8) Enter the difference but not less than zero...............................................

10.

Payments: (a) Tax Withheld (Attach 1099s, I-290s, and/or W-2s)

(b) Paid by Declaration

(c) Paid with Tentative Return

11.

11.

Total Payments (add lines 10a through 10c)................................................................................................

12.

12.

Balance of Tax Due (line 9 less line 11)........................................................................................................

Interest Due

Penalty Due

(See instructions for penalty and interest.)

13.

13.

TOTAL INCOME TAX,

. . . . . . . . . . . . . . . . . . . BALANCE DUE

14.

Interest and Penalty (add lines 12 and 13)

14.

15.

OVERPAYMENT (line 11 less line 9)

To be applied as follows:

(a) Estimated Tax

(b) REFUNDED

M

ake check payable to: South Carolina Department of Revenue. Include Business Name, FEIN and SC File #.

33151028

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4