Form Sc Sch.tc-17 - Recycling Property Tax Credit Per S.c. Code Section 12-6-3460

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

SC SCH.TC-17

DEPARTMENT OF REVENUE

RECYCLING PROPERTY TAX CREDIT

(Rev. 7/20/07)

PER S.C. CODE SECTION 12-6-3460

3367

20

Attach to your Tax Return

Name As Shown On Tax Return

SS No. or Fed. EI No.

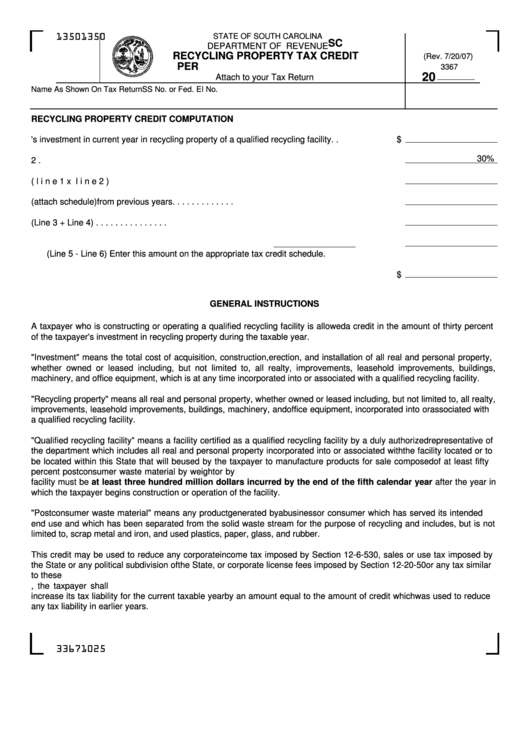

RECYCLING PROPERTY CREDIT COMPUTATION

1. Taxpayer's investment in current year in recycling property of a qualified recycling facility. .

$

30%

2. Recycling property credit rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Current year credit (line 1 x line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Recycling property credit carry-over (attach schedule) from previous years . . . . . . . . . . . . .

5. Total recycling property credits eligible for use this year (Line 3 + Line 4) . . . . . . . . . . . . . . .

6. Net recycling property credits used in current year against

tax. . . . . .

(Line 5 - Line 6) Enter this amount on the appropriate tax credit schedule.

7. Carry-forward to future years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

GENERAL INSTRUCTIONS

A taxpayer who is constructing or operating a qualified recycling facility is allowed a credit in the amount of thirty percent

of the taxpayer's investment in recycling property during the taxable year.

"Investment" means the total cost of acquisition, construction, erection, and installation of all real and personal property,

whether owned or leased including, but not limited to, all realty, improvements, leasehold improvements, buildings,

machinery, and office equipment, which is at any time incorporated into or associated with a qualified recycling facility.

"Recycling property" means all real and personal property, whether owned or leased including, but not limited to, all realty,

improvements, leasehold improvements, buildings, machinery, and office equipment, incorporated into or associated with

a qualified recycling facility.

"Qualified recycling facility" means a facility certified as a qualified recycling facility by a duly authorized representative of

the department which includes all real and personal property incorporated into or associated with the facility located or to

be located within this State that will be used by the taxpayer to manufacture products for sale composed of at least fifty

percent postconsumer waste material by weight or by volume. The minimum level of investment for a qualified recycling

facility must be at least three hundred million dollars incurred by the end of the fifth calendar year after the year in

which the taxpayer begins construction or operation of the facility.

"Postconsumer waste material" means any product generated by a business or consumer which has served its intended

end use and which has been separated from the solid waste stream for the purpose of recycling and includes, but is not

limited to, scrap metal and iron, and used plastics, paper, glass, and rubber.

This credit may be used to reduce any corporate income tax imposed by Section 12-6-530, sales or use tax imposed by

the State or any political subdivision of the State, or corporate license fees imposed by Section 12-20-50 or any tax similar

to these taxes. Any unused credit for a taxable year may be carried forward to subsequent taxable years until the credit is

exhausted. If the recycling facility fails to meet the minimum investment within the time required, the taxpayer shall

increase its tax liability for the current taxable year by an amount equal to the amount of credit which was used to reduce

any tax liability in earlier years.

33671025

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2