Form L-80 - Tracer Request

Download a blank fillable Form L-80 - Tracer Request in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form L-80 - Tracer Request with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

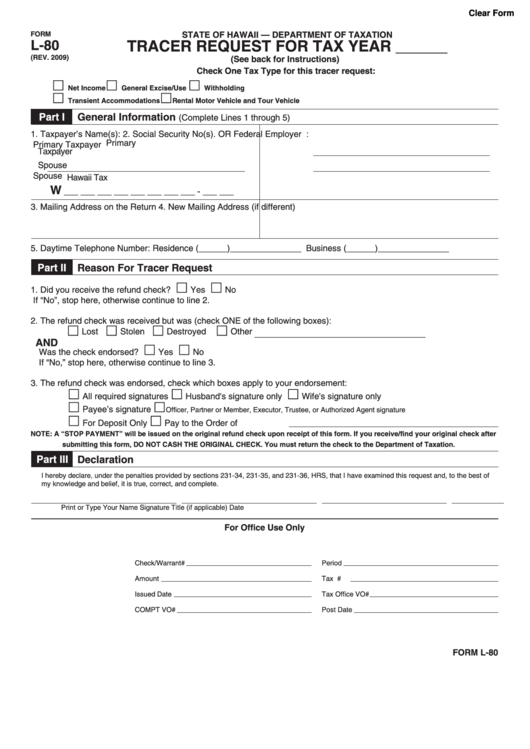

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

L-80

TRACER REQUEST FOR TAX YEAR ______

(REV. 2009)

(See back for Instructions)

Check One Tax Type for this tracer request:

Net Income

General Excise/Use

Withholding

Transient Accommodations

Rental Motor Vehicle and Tour Vehicle

Part I

General Information

(Complete Lines 1 through 5)

1. Taxpayer’s Name(s):

2. Social Security No(s). OR Federal Employer I.D. No.:

Primary

Primary Taxpayer

Taxpayer

Spouse

Spouse

Hawaii Tax I.D. Number for the tax account indicated above

W

___ ___ ___ ___ ___ ___ ___ ___ - ___ ___

3. Mailing Address on the Return

4. New Mailing Address (if different)

5. Daytime Telephone Number:

Residence (______)_______________

Business (______)_______________

Part II

Reason For Tracer Request

1. Did you receive the refund check?

Yes

No

If “No”, stop here, otherwise continue to line 2.

2. The refund check was received but was (check ONE of the following boxes):

Lost

Stolen

Destroyed

Other ____________________________________

AND

Was the check endorsed?

Yes

No

If “No,” stop here, otherwise continue to line 3.

3. The refund check was endorsed, check which boxes apply to your endorsement:

All required signatures

Husband's signature only

Wife's signature only

Payee’s signature

Officer, Partner or Member, Executor, Trustee, or Authorized Agent signature

For Deposit Only

Pay to the Order of

NOTE:

A “STOP PAYMENT” will be issued on the original refund check upon receipt of this form. If you receive/find your original check after

submitting this form, DO NOT CASH THE ORIGINAL CHECK. You must return the check to the Department of Taxation.

Part III

Declaration

I hereby declare, under the penalties provided by sections 231-34, 231-35, and 231-36, HRS, that I have examined this request and, to the best of

my knowledge and belief, it is true, correct, and complete.

Print or Type Your Name

Signature

Title (if applicable)

Date

For Office Use Only

Check/Warrant#

Period

Amount

Tax I.D.#

Issued Date

Tax Office VO#

COMPT VO#

Post Date

FORM L-80

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2