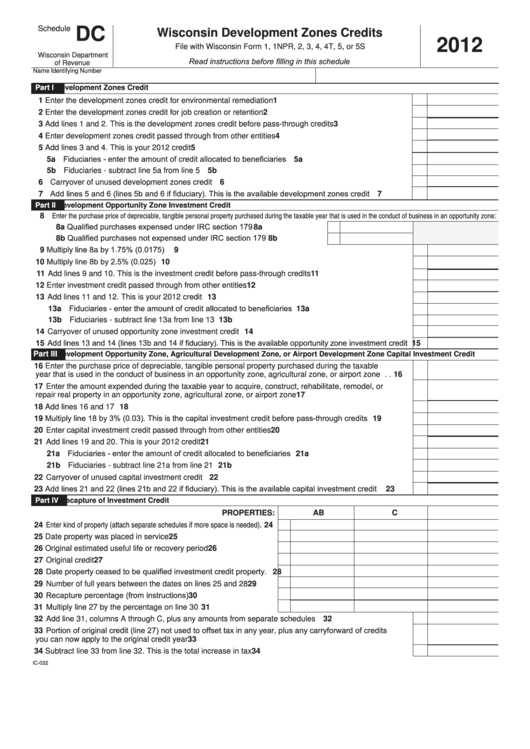

Schedule

DC

Wisconsin Development Zones Credits

2012

File with Wisconsin Form 1, 1NPR, 2, 3, 4, 4T, 5, or 5S

Wisconsin Department

Read instructions before filling in this schedule

of Revenue

Identifying Number

Name

Part I

Development Zones Credit

1 Enter the development zones credit for environmental remediation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Enter the development zones credit for job creation or retention . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Add lines 1 and 2 . This is the development zones credit before pass-through credits . . . . . . . . . . . . . . . . 3

4 Enter development zones credit passed through from other entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Add lines 3 and 4 . This is your 2012 credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

5a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . . . . . . . 5a

5b Fiduciaries - subtract line 5a from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5b

6 Carryover of unused development zones credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Add lines 5 and 6 (lines 5b and 6 if fiduciary). This is the available development zones credit . . . . . . . . . 7

Part II

Development Opportunity Zone Investment Credit

:

Enter the purchase price of depreciable, tangible personal property purchased during the taxable year that is used in the conduct of business in an opportunity zone

8

8a Qualified purchases expensed under IRC section 179 . . . . . . . . . . . . . . . . . 8a

8b Qualified purchases not expensed under IRC section 179 . . . . . . . . . . . . . . 8b

9 Multiply line 8a by 1.75% (0.0175) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Multiply line 8b by 2.5% (0.025) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Add lines 9 and 10 . This is the investment credit before pass-through credits . . . . . . . . . . . . . . . . . . . . .

11

12 Enter investment credit passed through from other entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Add lines 11 and 12 . This is your 2012 credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

13a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . . . . . . 13a

13b Fiduciaries - subtract line 13a from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13b

14 Carryover of unused opportunity zone investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Add lines 13 and 14 (lines 13b and 14 if fiduciary). This is the available opportunity zone investment credit 15

Part III

Development Opportunity Zone, Agricultural Development Zone, or Airport Development Zone Capital Investment Credit

16 Enter the purchase price of depreciable, tangible personal property purchased during the taxable

year that is used in the conduct of business in an opportunity zone, agricultural zone, or airport zone . . 16

17 Enter the amount expended during the taxable year to acquire, construct, rehabilitate, remodel, or

repair real property in an opportunity zone, agricultural zone, or airport zone . . . . . . . . . . . . . . . . . . . . . . 17

18 Add lines 16 and 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Multiply line 18 by 3% (0.03). This is the capital investment credit before pass-through credits . . . . . . . . 19

20 Enter capital investment credit passed through from other entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Add lines 19 and 20 . This is your 2012 credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

21a Fiduciaries - enter the amount of credit allocated to beneficiaries . . . . . . . . . . . . . . . . . . . . . . . . . . 21a

21b Fiduciaries - subtract line 21a from line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21b

22 Carryover of unused capital investment credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Add lines 21 and 22 (lines 21b and 22 if fiduciary). This is the available capital investment credit . . . . . . 23

Part IV

Recapture of Investment Credit

A

B

C

PROPERTIES:

Enter kind of property (attach separate schedules if more space is needed) . 24

24

25

Date property was placed in service . . . . . . . . . . . . . . . . . . . . . . . 25

26

Original estimated useful life or recovery period . . . . . . . . . . . . . 26

27

Original credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

Date property ceased to be qualified investment credit property . 28

28

29

Number of full years between the dates on lines 25 and 28 . . . . . 29

Recapture percentage (from instructions) . . . . . . . . . . . . . . . . . . 30

30

31

Multiply line 27 by the percentage on line 30 . . . . . . . . . . . . . . . . 31

32

Add line 31, columns A through C, plus any amounts from separate schedules . . . . . . . . . . . . . . . . . . .

32

Portion of original credit (line 27) not used to offset tax in any year, plus any carryforward of credits

33

you can now apply to the original credit year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

34

Subtract line 33 from line 32 . This is the total increase in tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

IC-032

1

1