2011 Instructions for Form 541-ES

Estimated Tax For Fiduciaries

General Information

If the estate or trust must make estimated tax

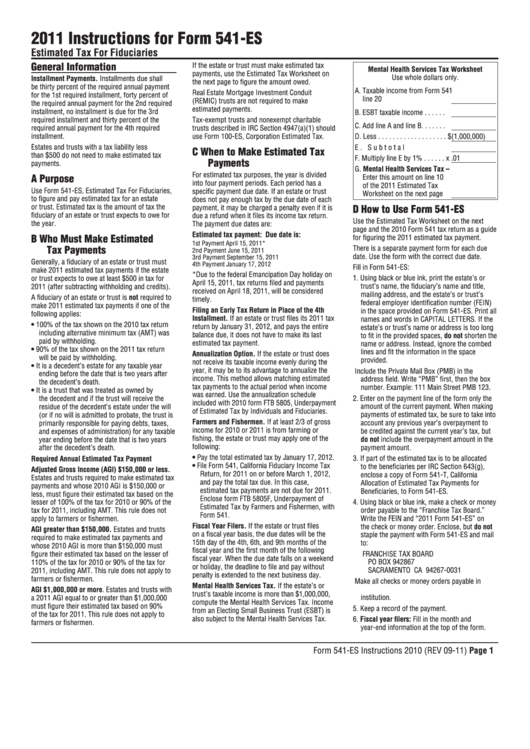

Mental Health Services Tax Worksheet

payments, use the Estimated Tax Worksheet on

Use whole dollars only.

Installment Payments. Installments due shall

the next page to figure the amount owed.

be thirty percent of the required annual payment

A. Taxable income from Form 541

Real Estate Mortgage Investment Conduit

for the 1st required installment, forty percent of

line 20. . . . . . . . . . . . . . . . . .

(REMIC) trusts are not required to make

the required annual payment for the 2nd required

estimated payments.

installment, no installment is due for the 3rd

B. ESBT taxable income . . . . . .

required installment and thirty percent of the

Tax-exempt trusts and nonexempt charitable

C. Add line A and line B. . . . . . .

required annual payment for the 4th required

trusts described in IRC Section 4947(a)(1) should

installment.

use Form 100-ES, Corporation Estimated Tax.

D. Less . . . . . . . . . . . . . . . . . . .

$(1,000,000)

Estates and trusts with a tax liability less

E. Subtotal . . . . . . . . . . . . . . . .

C When to Make Estimated Tax

than $500 do not need to make estimated tax

F. Multiply line E by 1% . . . . . .

x .01

Payments

payments.

G. Mental Health Services Tax –

For estimated tax purposes, the year is divided

A Purpose

Enter this amount on line 10

into four payment periods. Each period has a

of the 2011 Estimated Tax

Use Form 541-ES, Estimated Tax For Fiduciaries,

specific payment due date. If an estate or trust

Worksheet on the next page

to figure and pay estimated tax for an estate

does not pay enough tax by the due date of each

or trust. Estimated tax is the amount of tax the

D How to Use Form 541-ES

payment, it may be charged a penalty even if it is

fiduciary of an estate or trust expects to owe for

due a refund when it files its income tax return.

Use the Estimated Tax Worksheet on the next

the year.

The payment due dates are:

page and the 2010 Form 541 tax return as a guide

Estimated tax payment:

Due date is:

B Who Must Make Estimated

for figuring the 2011 estimated tax payment.

1st Payment

April 15, 2011*

Tax Payments

There is a separate payment form for each due

2nd Payment

June 15, 2011

date. Use the form with the correct due date.

3rd Payment

September 15, 2011

Generally, a fiduciary of an estate or trust must

4th Payment

January 17, 2012

Fill in Form 541-ES:

make 2011 estimated tax payments if the estate

*Due to the federal Emancipation Day holiday on

1. Using black or blue ink, print the estate’s or

or trust expects to owe at least $500 in tax for

April 15, 2011, tax returns filed and payments

2011 (after subtracting withholding and credits).

trust’s name, the fiduciary’s name and title,

received on April 18, 2011, will be considered

mailing address, and the estate’s or trust’s

A fiduciary of an estate or trust is not required to

timely.

federal employer identification number (FEIN)

make 2011 estimated tax payments if one of the

Filing an Early Tax Return in Place of the 4th

in the space provided on Form 541-ES. Print all

following applies:

Installment. If an estate or trust files its 2011 tax

names and words in CAPITAL LETTERS. If the

• 100% of the tax shown on the 2010 tax return

return by January 31, 2012, and pays the entire

estate’s or trust’s name or address is too long

including alternative minimum tax (AMT) was

balance due, it does not have to make its last

to fit in the provided spaces, do not shorten the

paid by withholding.

estimated tax payment.

name or address. Instead, ignore the combed

• 90% of the tax shown on the 2011 tax return

lines and fit the information in the space

Annualization Option. If the estate or trust does

will be paid by withholding.

provided.

not receive its taxable income evenly during the

• It is a decedent’s estate for any taxable year

year, it may be to its advantage to annualize the

Include the Private Mail Box (PMB) in the

ending before the date that is two years after

income. This method allows matching estimated

address field. Write “PMB” first, then the box

the decedent’s death.

tax payments to the actual period when income

number. Example: 111 Main Street PMB 123.

• It is a trust that was treated as owned by

was earned. Use the annualization schedule

the decedent and if the trust will receive the

2. Enter on the payment line of the form only the

included with 2010 form FTB 5805, Underpayment

amount of the current payment. When making

residue of the decedent’s estate under the will

of Estimated Tax by Individuals and Fiduciaries.

(or if no will is admitted to probate, the trust is

payments of estimated tax, be sure to take into

Farmers and Fishermen. If at least 2/3 of gross

account any previous year’s overpayment to

primarily responsible for paying debts, taxes,

income for 2010 or 2011 is from farming or

be credited against the current year’s tax, but

and expenses of administration) for any taxable

fishing, the estate or trust may apply one of the

year ending before the date that is two years

do not include the overpayment amount in the

following:

payment amount.

after the decedent’s death.

• Pay the total estimated tax by January 17, 2012.

Required Annual Estimated Tax Payment

3. If part of the estimated tax is to be allocated

• File Form 541, California Fiduciary Income Tax

to the beneficiaries per IRC Section 643(g),

Adjusted Gross Income (AGI) $�50,000 or less.

Return, for 2011 on or before March 1, 2012,

enclose a copy of Form 541-T, California

Estates and trusts required to make estimated tax

and pay the total tax due. In this case,

Allocation of Estimated Tax Payments for

payments and whose 2010 AGI is $150,000 or

estimated tax payments are not due for 2011.

Beneficiaries, to Form 541-ES.

less, must figure their estimated tax based on the

Enclose form FTB 5805F, Underpayment of

lesser of 100% of the tax for 2010 or 90% of the

4. Using black or blue ink, make a check or money

Estimated Tax by Farmers and Fishermen, with

order payable to the “Franchise Tax Board.”

tax for 2011, including AMT. This rule does not

Form 541.

apply to farmers or fishermen.

Write the FEIN and “2011 Form 541-ES” on

Fiscal Year Filers. If the estate or trust files

the check or money order. Enclose, but do not

AGI greater than $�50,000. Estates and trusts

on a fiscal year basis, the due dates will be the

staple the payment with Form 541-ES and mail

required to make estimated tax payments and

15th day of the 4th, 6th, and 9th months of the

to:

whose 2010 AGI is more than $150,000 must

fiscal year and the first month of the following

FRANCHISE TAX BOARD

figure their estimated tax based on the lesser of

fiscal year. When the due date falls on a weekend

110% of the tax for 2010 or 90% of the tax for

PO BOX 942867

or holiday, the deadline to file and pay without

SACRAMENTO CA 94267-0031

2011, including AMT. This rule does not apply to

penalty is extended to the next business day.

farmers or fishermen.

Make all checks or money orders payable in

Mental Health Services Tax. If the estate’s or

U.S. dollars and drawn against a U.S. financial

AGI $�,000,000 or more. Estates and trusts with

trust’s taxable income is more than $1,000,000,

institution.

a 2011 AGI equal to or greater than $1,000,000

compute the Mental Health Services Tax. Income

must figure their estimated tax based on 90%

5. Keep a record of the payment.

from an Electing Small Business Trust (ESBT) is

of the tax for 2011. This rule does not apply to

also subject to the Mental Health Services Tax.

6. Fiscal year filers: Fill in the month and

farmers or fishermen.

year-end information at the top of the form.

Form 541-ES Instructions 2010 (REV 09-11) Page �

1

1 2

2 3

3