Form 06-22 - Rulings Of The Tax Commissioner

ADVERTISEMENT

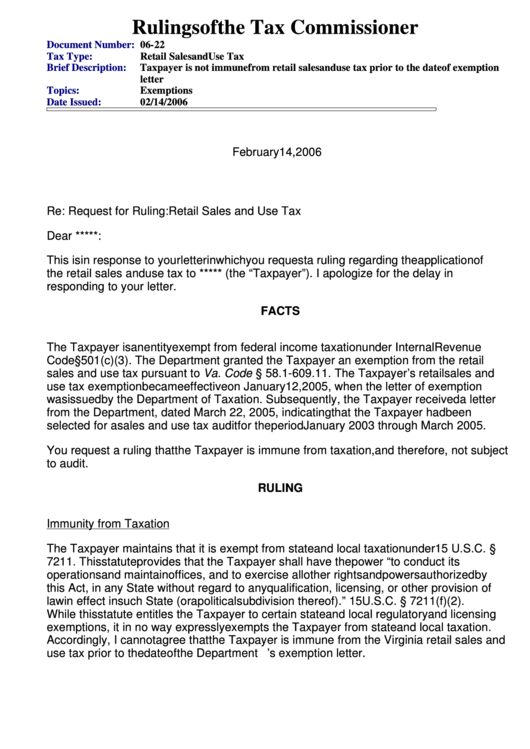

Rulings of the Tax Commissioner

Document Number:

06-22

Tax Type:

Retail Sales and Use Tax

Brief Description:

Taxpayer is not immune from retail sales and use tax prior to the date of exemption

letter

Topics:

Exemptions

Date Issued:

02/14/2006

February 14, 2006

Re: Request for Ruling: Retail Sales and Use Tax

Dear *****:

This is in response to your letter in which you request a ruling regarding the application of

the retail sales and use tax to ***** (the “Taxpayer”). I apologize for the delay in

responding to your letter.

FACTS

The Taxpayer is an entity exempt from federal income taxation under Internal Revenue

Code § 501(c)(3). The Department granted the Taxpayer an exemption from the retail

sales and use tax pursuant to Va. Code § 58.1-609.11. The Taxpayer’s retail sales and

use tax exemption became effective on January 12, 2005, when the letter of exemption

was issued by the Department of Taxation. Subsequently, the Taxpayer received a letter

from the Department, dated March 22, 2005, indicating that the Taxpayer had been

selected for a sales and use tax audit for the period January 2003 through March 2005.

You request a ruling that the Taxpayer is immune from taxation, and therefore, not subject

to audit.

RULING

Immunity from Taxation

The Taxpayer maintains that it is exempt from state and local taxation under 15 U.S.C. §

7211. This statute provides that the Taxpayer shall have the power “to conduct its

operations and maintain offices, and to exercise all other rights and powers authorized by

this Act, in any State without regard to any qualification, licensing, or other provision of

law in effect in such State (or a political subdivision thereof).” 15 U.S.C. § 7211(f)(2).

While this statute entitles the Taxpayer to certain state and local regulatory and licensing

exemptions, it in no way expressly exempts the Taxpayer from state and local taxation.

Accordingly, I cannot agree that the Taxpayer is immune from the Virginia retail sales and

use tax prior to the date of the Department’s exemption letter.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2