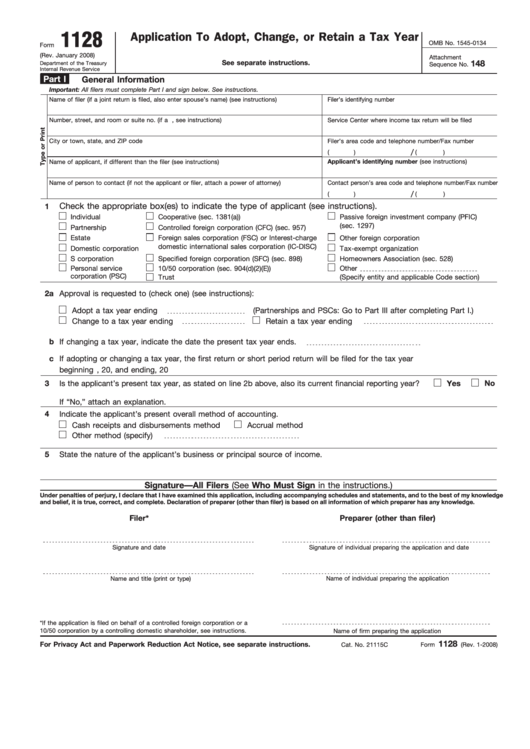

1128

Application To Adopt, Change, or Retain a Tax Year

OMB No. 1545-0134

Form

(Rev. January 2008)

Attachment

See separate instructions.

148

Department of the Treasury

Sequence No.

Internal Revenue Service

Part I

General Information

Important: All filers must complete Part I and sign below. See instructions.

Name of filer (if a joint return is filed, also enter spouse’s name) (see instructions)

Filer’s identifying number

Number, street, and room or suite no. (if a P.O. box, see instructions)

Service Center where income tax return will be filed

City or town, state, and ZIP code

Filer’s area code and telephone number/Fax number

/

(

)

(

)

Name of applicant, if different than the filer (see instructions)

Applicant’s identifying number (see instructions)

Name of person to contact (if not the applicant or filer, attach a power of attorney)

Contact person’s area code and telephone number/Fax number

/

(

)

(

)

Check the appropriate box(es) to indicate the type of applicant (see instructions).

1

Individual

Cooperative (sec. 1381(a))

Passive foreign investment company (PFIC)

(sec. 1297)

Partnership

Controlled foreign corporation (CFC) (sec. 957)

Estate

Foreign sales corporation (FSC) or Interest-charge

Other foreign corporation

domestic international sales corporation (IC-DISC)

Domestic corporation

Tax-exempt organization

S corporation

Specified foreign corporation (SFC) (sec. 898)

Homeowners Association (sec. 528)

Personal service

10/50 corporation (sec. 904(d)(2)(E))

Other

corporation (PSC)

Trust

(Specify entity and applicable Code section)

2a

Approval is requested to (check one) (see instructions):

Adopt a tax year ending

(Partnerships and PSCs: Go to Part III after completing Part I.)

Change to a tax year ending

Retain a tax year ending

b

If changing a tax year, indicate the date the present tax year ends.

c

If adopting or changing a tax year, the first return or short period return will be filed for the tax year

beginning

, 20

, and ending

, 20

3

Is the applicant’s present tax year, as stated on line 2b above, also its current financial reporting year?

Yes

No

If “No,” attach an explanation.

4

Indicate the applicant’s present overall method of accounting.

Cash receipts and disbursements method

Accrual method

Other method (specify)

5

State the nature of the applicant’s business or principal source of income.

Signature—All Filers (See Who Must Sign in the instructions.)

Under penalties of perjury, I declare that I have examined this application, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than filer) is based on all information of which preparer has any knowledge.

Filer*

Preparer (other than filer)

Signature and date

Signature of individual preparing the application and date

Name and title (print or type)

Name of individual preparing the application

*If the application is filed on behalf of a controlled foreign corporation or a

10/50 corporation by a controlling domestic shareholder, see instructions.

Name of firm preparing the application

1128

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 21115C

Form

(Rev. 1-2008)

1

1 2

2 3

3 4

4