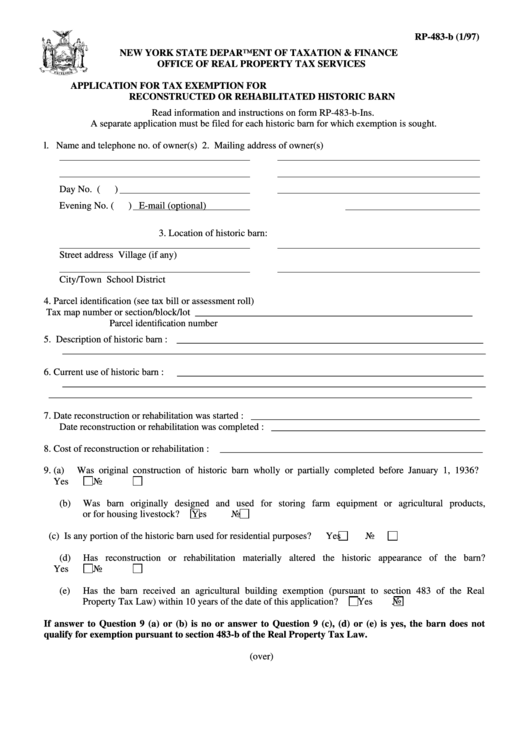

RP-483-b (1/97)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR TAX EXEMPTION FOR

RECONSTRUCTED OR REHABILITATED HISTORIC BARN

Read information and instructions on form RP-483-b-Ins.

A separate application must be filed for each historic barn for which exemption is sought.

l.

Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail (optional)

3. Location of historic barn:

Street address

Village (if any)

City/Town

School District

4. Parcel identification (see tax bill or assessment roll)

Tax map number or section/block/lot _________________________________________________________

Parcel identification number

5. Description of historic barn :

_______________________________________________________________

_______________________________________________________________________________________

6. Current use of historic barn :

_______________________________________________________________

_______________________________________________________________________________________

_______________________________________________________________________________________

7. Date reconstruction or rehabilitation was started : _______________________________________________

Date reconstruction or rehabilitation was completed : ____________________________________________

8. Cost of reconstruction or rehabilitation :

______________________________________________________

9. (a)

Was original construction of historic barn wholly or partially completed before January 1, 1936?

Yes

No

(b)

Was barn originally designed and used for storing farm equipment or agricultural products,

or for housing livestock?

Yes

No

(c)

Is any portion of the historic barn used for residential purposes?

Yes

No

(d)

Has reconstruction or rehabilitation materially altered the historic appearance of the barn?

Yes

No

(e)

Has the barn received an agricultural building exemption (pursuant to section 483 of the Real

Property Tax Law) within 10 years of the date of this application?

Yes

No

If answer to Question 9 (a) or (b) is no or answer to Question 9 (c), (d) or (e) is yes, the barn does not

qualify for exemption pursuant to section 483-b of the Real Property Tax Law.

(over)

1

1 2

2