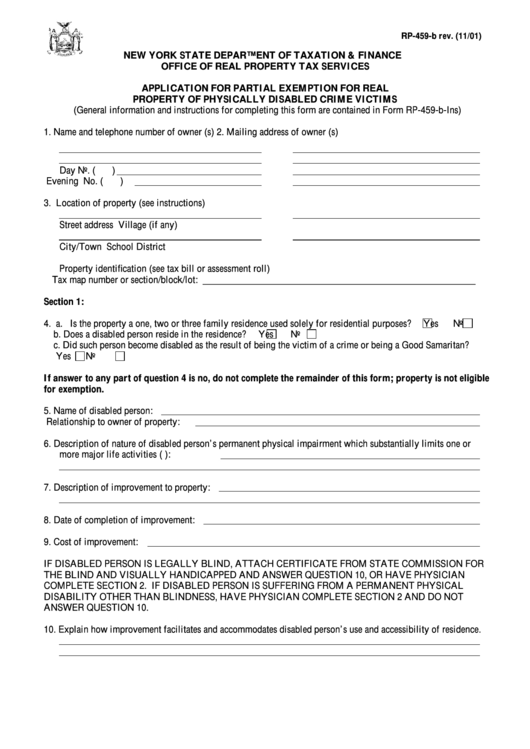

RP-459-b rev. (11/01)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR PARTIAL EXEMPTION FOR REAL

PROPERTY OF PHYSICALLY DISABLED CRIME VICTIMS

(General information and instructions for completing this form are contained in Form RP-459-b-Ins)

1. Name and telephone number of owner (s)

2. Mailing address of owner (s)

Day No. (

)

Evening No. (

)

3. Location of property (see instructions)

Street address

Village (if any)

City/Town

School District

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot: ________________________________________________________

Section 1:

4. a. Is the property a one, two or three family residence used solely for residential purposes?

Yes

No

b. Does a disabled person reside in the residence?

Yes

No

c. Did such person become disabled as the result of being the victim of a crime or being a Good Samaritan?

Yes

No

If answer to any part of question 4 is no, do not complete the remainder of this form; property is not eligible

for exemption.

5. Name of disabled person:

Relationship to owner of property:

6. Description of nature of disabled person’s permanent physical impairment which substantially limits one or

more major life activities (e.g. walking):

7. Description of improvement to property:

8. Date of completion of improvement:

9. Cost of improvement:

IF DISABLED PERSON IS LEGALLY BLIND, ATTACH CERTIFICATE FROM STATE COMMISSION FOR

THE BLIND AND VISUALLY HANDICAPPED AND ANSWER QUESTION 10, OR HAVE PHYSICIAN

COMPLETE SECTION 2. IF DISABLED PERSON IS SUFFERING FROM A PERMANENT PHYSICAL

DISABILITY OTHER THAN BLINDNESS, HAVE PHYSICIAN COMPLETE SECTION 2 AND DO NOT

ANSWER QUESTION 10.

10. Explain how improvement facilitates and accommodates disabled person’s use and accessibility of residence.

1

1 2

2