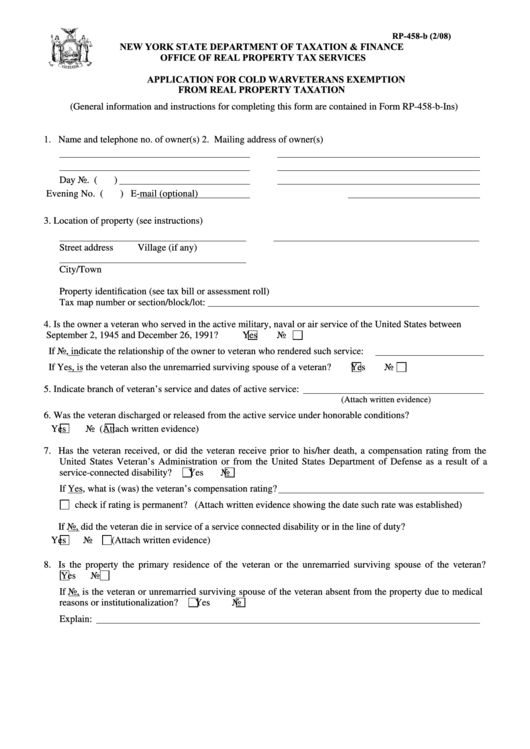

RP-458-b (2/08)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR COLD WAR VETERANS EXEMPTION

FROM REAL PROPERTY TAXATION

(General information and instructions for completing this form are contained in Form RP-458-b-Ins)

1. Name and telephone no. of owner(s)

2. Mailing address of owner(s)

Day No. (

)

Evening No. (

)

E-mail (optional)

3. Location of property (see instructions)

Street address

Village (if any)

City/Town

Property identification (see tax bill or assessment roll)

Tax map number or section/block/lot:

4. Is the owner a veteran who served in the active military, naval or air service of the United States between

September 2, 1945 and December 26, 1991?

Yes

No

If No, indicate the relationship of the owner to veteran who rendered such service:

If Yes, is the veteran also the unremarried surviving spouse of a veteran?

Yes

No

5. Indicate branch of veteran’s service and dates of active service:

(Attach written evidence)

6. Was the veteran discharged or released from the active service under honorable conditions?

Yes

No (Attach written evidence)

7. Has the veteran received, or did the veteran receive prior to his/her death, a compensation rating from the

United States Veteran’s Administration or from the United States Department of Defense as a result of a

service-connected disability?

Yes

No

If Yes, what is (was) the veteran’s compensation rating?

check if rating is permanent?

(Attach written evidence showing the date such rate was established)

If No, did the veteran die in service of a service connected disability or in the line of duty?

Yes

No

(Attach written evidence)

8. Is the property the primary residence of the veteran or the unremarried surviving spouse of the veteran?

Yes

No

If No, is the veteran or unremarried surviving spouse of the veteran absent from the property due to medical

reasons or institutionalization?

Yes

No

Explain:

1

1 2

2