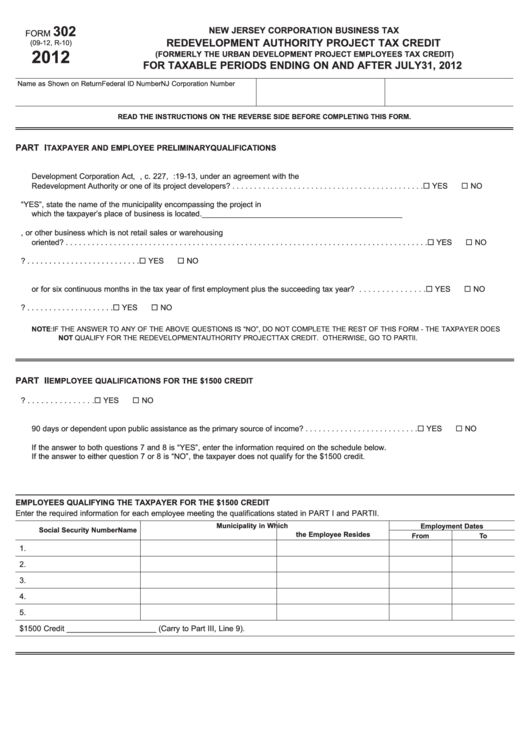

302

NEW JERSEY CORPORATION BUSINESS TAX

FORM

REDEVELOPMENT AUTHORITY PROJECT TAX CREDIT

(09-12, R-10)

2012

(FORMERLY THE URBAN DEVELOPMENT PROJECT EMPLOYEES TAX CREDIT)

FOR TAXABLE PERIODS ENDING ON AND AFTER JULY 31, 2012

Name as Shown on Return

Federal ID Number

NJ Corporation Number

READ THE INSTRUCTIONS ON THE REVERSE SIDE BEFORE COMPLETING THIS FORM.

PART I

TAXPAYER AND EMPLOYEE PRELIMINARY QUALIFICATIONS

1. Is the taxpayer conducting a business within a project location as defined in the New Jersey Urban

Development Corporation Act, P.L. 1985, c. 227, N.J.S.A. 55:19-13, under an agreement with the

Redevelopment Authority or one of its project developers? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

2. If the answer to the above question is “YES”, state the name of the municipality encompassing the project in

which the taxpayer’s place of business is located._______________________________________________

3. Is the taxpayer primarily a manufacturing concern, or other business which is not retail sales or warehousing

oriented? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

4. Was the new employee hired during the tax year for which the credit is claimed? . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

5. Was the new employee employed for at least six continuous months during the tax year of first employment

or for six continuous months in the tax year of first employment plus the succeeding tax year? . . . . . . . . . . . . . . .

YES

NO

6. Was the new employee hired on or after the date of closing of the development project? . . . . . . . . . . . . . . . . . . . .

YES

NO

NOTE: IF THE ANSWER TO ANY OF THE ABOVE QUESTIONS IS “NO”, DO NOT COMPLETE THE REST OF THIS FORM - THE TAXPAYER DOES

NOT QUALIFY FOR THE REDEVELOPMENT AUTHORITY PROJECT TAX CREDIT. OTHERWISE, GO TO PART II.

PART II

EMPLOYEE QUALIFICATIONS FOR THE $1500 CREDIT

7. Was the new employee a resident of the qualified municipality in which the project is located? . . . . . . . . . . . . . . .

YES

NO

8. Was the new employee immediately prior to employment by the taxpayer either unemployed for at least

90 days or dependent upon public assistance as the primary source of income? . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

If the answer to both questions 7 and 8 is “YES”, enter the information required on the schedule below.

If the answer to either question 7 or 8 is “NO”, the taxpayer does not qualify for the $1500 credit.

EMPLOYEES QUALIFYING THE TAXPAYER FOR THE $1500 CREDIT

Enter the required information for each employee meeting the qualifications stated in PART I and PART II.

Municipality in Which

Employment Dates

Social Security Number

Name

the Employee Resides

From

To

1.

2.

3.

4.

5.

6. Total number of employees qualifying the taxpayer for $1500 Credit _____________________ (Carry to Part III, Line 9).

1

1 2

2 3

3