Form Nc-1099-Itin - Compensation Paid To An Itin Contractor - North Carolina Department Of Revenue

ADVERTISEMENT

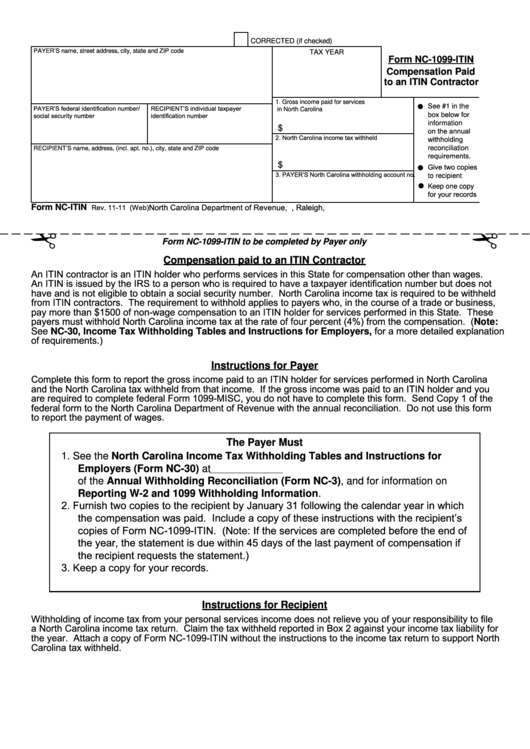

CORRECTED (if checked)

PAYER’S name, street address, city, state and ZIP code

TAX YEAR

Form NC-1099-ITIN

Compensation Paid

to an ITIN Contractor

1. Gross income paid for services

See #1 in the

PAYER’S federal identification number/

RECIPIENT’S individual taxpayer

in North Carolina

box below for

social security number

identification number

information

$

on the annual

2. North Carolina income tax withheld

withholding

reconciliation

RECIPIENT’S name, address, (incl. apt. no.), city, state and ZIP code

requirements.

$

Give two copies

3. PAYER’S North Carolina withholding account no.

to recipient

Keep one copy

for your records

North Carolina Department of Revenue, P.O. Box 25000, Raleigh, N.C. 27640-0001

Rev. 11-11 (Web)

Form NC-ITIN

Form NC-1099-ITIN to be completed by Payer only

Compensation paid to an ITIN Contractor

An ITIN contractor is an ITIN holder who performs services in this State for compensation other than wages.

An ITIN is issued by the IRS to a person who is required to have a taxpayer identification number but does not

have and is not eligible to obtain a social security number. North Carolina income tax is required to be withheld

from ITIN contractors. The requirement to withhold applies to payers who, in the course of a trade or business,

pay more than $1500 of non-wage compensation to an ITIN holder for services performed in this State. These

payers must withhold North Carolina income tax at the rate of four percent (4%) from the compensation. (Note:

See NC-30, Income Tax Withholding Tables and Instructions for Employers, for a more detailed explanation

of requirements.)

Instructions for Payer

Complete this form to report the gross income paid to an ITIN holder for services performed in North Carolina

and the North Carolina tax withheld from that income. If the gross income was paid to an ITIN holder and you

are required to complete federal Form 1099-MISC, you do not have to complete this form. Send Copy 1 of the

federal form to the North Carolina Department of Revenue with the annual reconciliation. Do not use this form

to report the payment of wages.

The Payer Must

1. See the North Carolina Income Tax Withholding Tables and Instructions for

Employers (Form NC-30) at for information regarding the submission

of the Annual Withholding Reconciliation (Form NC-3), and for information on

Reporting W-2 and 1099 Withholding Information.

2. Furnish two copies to the recipient by January 31 following the calendar year in which

the compensation was paid. Include a copy of these instructions with the recipient’s

copies of Form NC-1099-ITIN. (Note: If the services are completed before the end of

the year, the statement is due within 45 days of the last payment of compensation if

the recipient requests the statement.)

3. Keep a copy for your records.

Instructions for Recipient

Withholding of income tax from your personal services income does not relieve you of your responsibility to file

a North Carolina income tax return. Claim the tax withheld reported in Box 2 against your income tax liability for

the year. Attach a copy of Form NC-1099-ITIN without the instructions to the income tax return to support North

Carolina tax withheld.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1