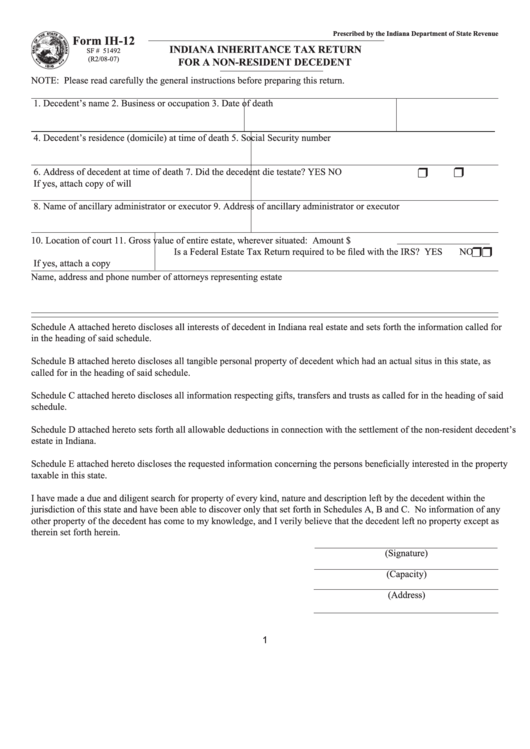

Prescribed by the Indiana Department of State Revenue

form Ih-12

InDIana InheRItance tax RetuRn

SF # 51492

(R2/08-07)

foR a non-ReSIDent DeceDent

note: Please read carefully the general instructions before preparing this return.

1. Decedent’s name

2. Business or occupation

3. Date of death

4. Decedent’s residence (domicile) at time of death

5. Social Security number

6. Address of decedent at time of death

7. Did the decedent die testate?

YeS

no

If yes, attach copy of will

8. name of ancillary administrator or executor

9. Address of ancillary administrator or executor

10. Location of court

11. Gross value of entire estate, wherever situated: Amount $

Is a Federal Estate Tax Return required to be filed with the IRS? YES NO

If yes, attach a copy

name, address and phone number of attorneys representing estate

Schedule A attached hereto discloses all interests of decedent in Indiana real estate and sets forth the information called for

in the heading of said schedule.

Schedule B attached hereto discloses all tangible personal property of decedent which had an actual situs in this state, as

called for in the heading of said schedule.

Schedule C attached hereto discloses all information respecting gifts, transfers and trusts as called for in the heading of said

schedule.

Schedule D attached hereto sets forth all allowable deductions in connection with the settlement of the non-resident decedent’s

estate in Indiana.

Schedule E attached hereto discloses the requested information concerning the persons beneficially interested in the property

taxable in this state.

I have made a due and diligent search for property of every kind, nature and description left by the decedent within the

jurisdiction of this state and have been able to discover only that set forth in Schedules A, B and C. no information of any

other property of the decedent has come to my knowledge, and I verily believe that the decedent left no property except as

therein set forth herein.

(Signature)

(Capacity)

(Address)

�

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8