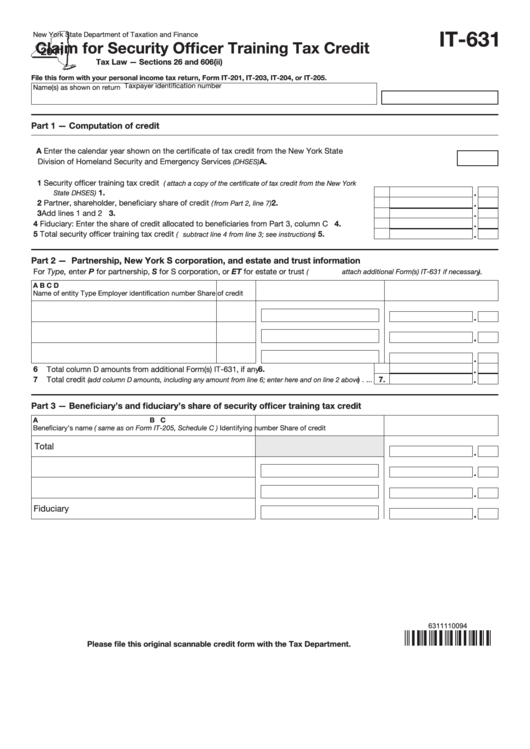

IT-631

New York State Department of Taxation and Finance

Claim for Security Officer Training Tax Credit

Tax Law — Sections 26 and 606(ii)

File this form with your personal income tax return, Form IT-201, IT-203, IT-204, or IT-205.

Taxpayer identification number

Name(s) as shown on return

Part 1 — Computation of credit

A Enter the calendar year shown on the certificate of tax credit from the New York State

Division of Homeland Security and Emergency Services

............................................................................ A.

(DHSES)

1 Security officer training tax credit

( attach a copy of the certificate of tax credit from the New York

.............................................................................................................................. 1.

State DHSES )

2 Partner, shareholder, beneficiary share of credit

............................................. 2.

( from Part 2, line 7 )

3 Add lines 1 and 2 ......................................................................................................................... 3.

4 Fiduciary: Enter the share of credit allocated to beneficiaries from Part 3, column C ................ 4.

5 Total security officer training tax credit

........................ 5.

( subtract line 4 from line 3; see instructions )

Part 2 — Partnership, New York S corporation, and estate and trust information

For Type, enter P for partnership, S for S corporation, or ET for estate or trust

.

( attach additional Form(s) IT-631 if necessary )

A

B

C

D

Name of entity

Type

Employer identification number

Share of credit

6 Total column D amounts from additional Form(s) IT-631, if any ..................................................... 6.

7 Total credit

) . ... 7.

( add column D amounts, including any amount from line 6; enter here and on line 2 above

Part 3 — Beneficiary’s and fiduciary’s share of security officer training tax credit

A

B

C

Beneficiary’s name ( same as on Form IT-205, Schedule C )

Identifying number

Share of credit

Total

Fiduciary

6311110094

Please file this original scannable credit form with the Tax Department.

1

1 2

2