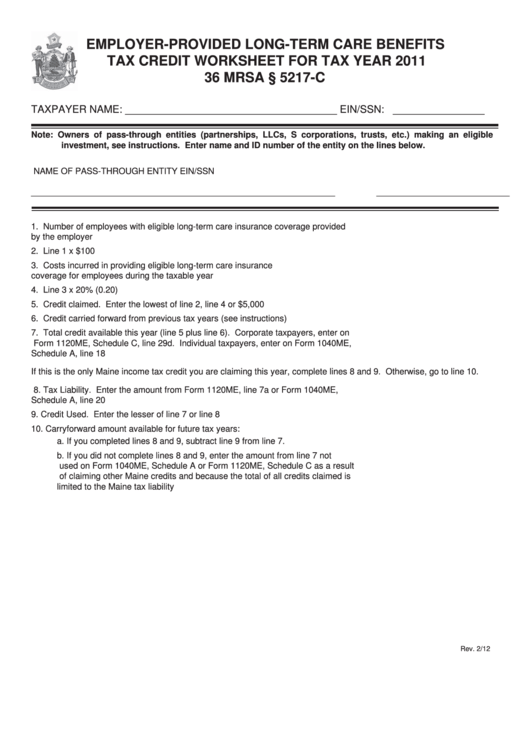

Employer-Provided Long-Term Care Benefits Tax Credit Worksheet - 2011

ADVERTISEMENT

EMPLOYER-PROVIDED LONG-TERM CARE BENEFITS

TAX CREDIT WORKSHEET FOR TAX YEAR 2011

36 MRSA § 5217-C

TAXPAYER NAME: _____________________________________ EIN/SSN: ________________

Note: Owners of pass-through entities (partnerships, LLCs, S corporations, trusts, etc.) making an eligible

investment, see instructions. Enter name and ID number of the entity on the lines below.

NAME OF PASS-THROUGH ENTITY

EIN/SSN

________________________________________________________________

____________________________

1.

Number of employees with eligible long-term care insurance coverage provided

by the employer .....................................................................................................................1. __________________

2.

Line 1 x $100 ..........................................................................................................................2. __________________

3.

Costs incurred in providing eligible long-term care insurance

coverage for employees during the taxable year ....................................................................3. __________________

4.

Line 3 x 20% (0.20) .................................................................................................................4. __________________

5.

Credit claimed. Enter the lowest of line 2, line 4 or $5,000 ....................................................5. __________________

6.

Credit carried forward from previous tax years (see instructions) ...........................................6. __________________

7.

Total credit available this year (line 5 plus line 6). Corporate taxpayers, enter on

Form 1120ME, Schedule C, line 29d. Individual taxpayers, enter on Form 1040ME,

Schedule A, line 18 .................................................................................................................7. __________________

If this is the only Maine income tax credit you are claiming this year, complete lines 8 and 9. Otherwise, go to line 10.

8. Tax Liability. Enter the amount from Form 1120ME, line 7a or Form 1040ME,

Schedule A, line 20 .................................................................................................................8. __________________

9. Credit Used. Enter the lesser of line 7 or line 8 .....................................................................9. __________________

10. Carryforward amount available for future tax years:

a.

If you completed lines 8 and 9, subtract line 9 from line 7.

b.

If you did not complete lines 8 and 9, enter the amount from line 7 not

used on Form 1040ME, Schedule A or Form 1120ME, Schedule C as a result

of claiming other Maine credits and because the total of all credits claimed is

limited to the Maine tax liability ...................................................................................10. __________________

Rev. 2/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2