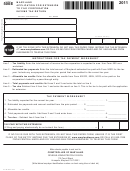

MARYLAND

INSTRUCTIONS

FOR

APPLICATION FOR EXTENSION TO FILE

PAGE 2

FORM 504E

FIDUCIARY INCOME TAX RETURN

2011

GENERAL INSTRUCTIONS

Interest

You will owe interest on tax not paid by the regular

Purpose of Form

due date of your return. The interest will accrue until

Use Form 504E to receive an automatic six month

you pay the tax. Even if you had a good reason not

extension to file Form 504.

to pay on time, you will still owe interest.

To get the extension you MUST:

Penalty

If tax and interest is not paid promptly, a penalty will

1. fill in Form 504E correctly AND

be assessed on the tax.

2. file it by the due date of your return AND

How to Claim Credit for Payment Made with This

Form

3. pay ALL of the amount shown on line 6.

When you file your return, show the amount of any

payment (line 6) sent with Form 504E on line 31 of

Fiduciaries requesting an extension of more than six

your return.

months must enter on this application the reason for

the request. No extension request will be granted

for more than six months, except in the case of a

fiduciary who is out of the United States. In no case

will an extension be granted for more than one year

from the due date for submitting the fiduciary tax

return. See Administrative Release 4.

When to File Form 504E

File Form 504E by April 15, 2012. If you are filing on

a fiscal year basis, file by the regular due date of

your return.

Where to File

Mail this form to the Maryland Revenue Administra-

tion Division, 110 Carroll Street, Annapolis, MD

21411-0001.

Filing Your Tax Return

You may file Form 504 at any time before the end of

the extension period. Remember, Form 504E does

not extend the time to pay taxes. If you do not pay

the amount due by the regular due date, you will

owe interest and be subject to a penalty.

1

1 2

2