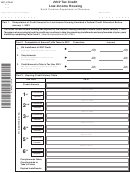

Form Sc1040tc - 2012 Tax Credits - 2012 Page 5

ADVERTISEMENT

CREDIT DESCRIPTIONS

CODE TITLE: Description. (Form)

CODE TITLE: Description. (Form)

041

RENEWABLE FUEL FACILITY CREDIT: For constructing

051

VENISON FOR CHARITY CREDIT: $50 for each carcass

a renewable fuel production or distribution facility in South

of deer meat prepared by a licensed meat packer, butcher

Carolina. (TC-41)

or processing plant for charity. (TC-51)

RESIDENTIAL RETROFIT CREDIT: For retrofitting a

FIRE SPRINKLER SYSTEM CREDIT: 25% of costs of

043

052

residence to make it more resistant to loss due to

voluntarily installing a fire sprinkler system in a structure.

hurricane, rising floodwater, or other catastrophic

(TC-52)

windstorm event. (TC-43)

ENERGY EFFICIENT MANUFACTURED HOME CREDIT:

053

044

EXCESS INSURANCE PREMIUM CREDIT: For excess

$750 credit for new purchase of an Energy Star

premiums paid for property and casualty insurance on a

manufactured home. (TC-53)

legal residence. (TC-44)

CREDIT FOR MANUFACTURING RENEWABLE ENERGY

054

045

APPRENTICESHIP CREDIT: For employing an apprentice.

SYSTEMS: For investing in production of renewable

(TC-45)

energy systems and components. (TC-54)

046

CREDIT FOR SHAREHOLDER OF S CORPORATION

BANKS: For shareholders of S corporations operating as

banks. (TC-46)

048

PLUG-IN HYBRID VEHICLE CREDIT: For in-State

purchase or lease of a plug-in hybrid vehicle. (TC-48)

Use TC-48A to apply for this credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5