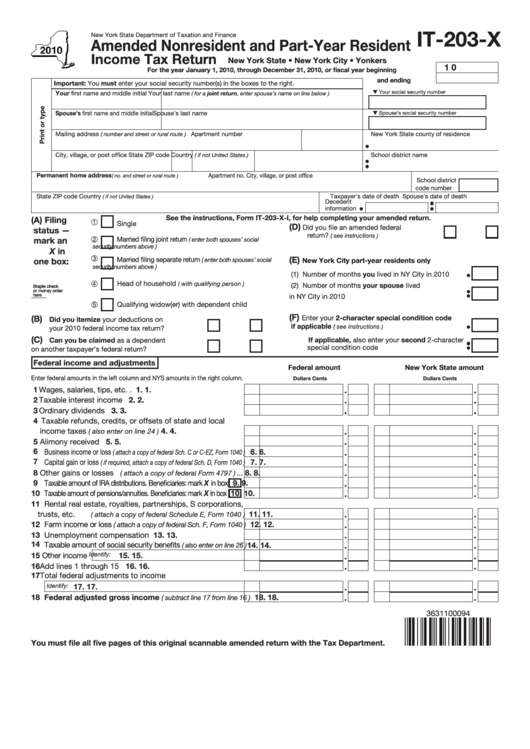

IT-203-X

New York State Department of Taxation and Finance

Amended Nonresident and Part-Year Resident

Income Tax Return

New York State • New York City • Yonkers

1 0

For the year January 1, 2010, through December 31, 2010, or fiscal year beginning ............

and ending ............

Important: You must enter your social security number(s) in the boxes to the right.

Your social security number

Your first name and middle initial

Your last name

( for a joint return, enter spouse’s name on line below )

Spouse’s first name and middle initial

Spouse’s last name

Spouse’s social security number

Mailing address

( number and street or rural route )

Apartment number

New York State county of residence

City, village, or post office

State

ZIP code

Country

School district name

( if not United States )

Permanent home address

Apartment no.

City, village, or post office

( no. and street or rural route )

School district

code number

State

ZIP code

Country

Taxpayer’s date of death Spouse’s date of death

( if not United States )

Decedent

information

See the instructions, Form IT-203-X-I, for help completing your amended return.

(A) Filing

Single

(D)

Did you file an amended federal

status —

return?

.......................... Yes

No

( see instructions )

Married filing joint return

mark an

( enter both spouses’ social

security numbers above )

X in

(E)

Married filing separate return

one box:

( enter both spouses’ social

New York City part-year residents only

security numbers above )

(1) Number of months you lived in NY City in 2010

Head of household

( with qualifying person )

(2) Number of months your spouse lived

Staple check

Staple check

or money order

or money order

here

here

in NY City in 2010 ...........................................

Qualifying widow(er) with dependent child

(F)

(B)

Enter your 2-character special condition code

Did you itemize your deductions on

if applicable

.................................

( see instructions )

your 2010 federal income tax return? .............. Yes

No

(C)

If applicable, also enter your second 2-character

Can you be claimed as a dependent

special condition code ...........................................

on another taxpayer’s federal return? .............. Yes

No

Federal income and adjustments

Federal amount

New York State amount

Enter federal amounts in the left column and NYS amounts in the right column.

Dollars

Cents

Dollars

Cents

1 Wages, salaries, tips, etc. . ................................................

1.

1.

2 Taxable interest income ....................................................

2.

2.

3 Ordinary dividends ...........................................................

3.

3.

4 Taxable refunds, credits, or offsets of state and local

4.

4.

income taxes

................................

( also enter on line 24 )

5 Alimony received ..............................................................

5.

5.

6 Business income or loss

6.

6.

( attach a copy of federal Sch. C or C-EZ, Form 1040 )

7 Capital gain or loss

7.

7.

( if required, attach a copy of federal Sch. D, Form 1040 )

8 Other gains or losses

...

8.

8.

( attach a copy of federal Form 4797 )

9 Taxable amount of IRA distributions. Beneficiaries: mark X in box

9.

9.

10 Taxable amount of pensions/annuities. Beneficiaries: mark X in box

10.

10.

11 Rental real estate, royalties, partnerships, S corporations,

trusts, etc.

11.

11.

( attach a copy of federal Schedule E, Form 1040 )

12 Farm income or loss

12.

12.

( attach a copy of federal Sch. F, Form 1040 )

13 Unemployment compensation .......................................... 13.

13.

14 Taxable amount of social security benefits

14.

14.

( also enter on line 26 )

15 Other income

Identify:

15.

15.

16 Add lines 1 through 15 ..................................................... 16.

16.

17 Total federal adjustments to income

Identify:

17.

17.

18 Federal adjusted gross income

18.

18.

( subtract line 17 from line 16 )

3631100094

You must file all five pages of this original scannable amended return with the Tax Department.

1

1 2

2 3

3 4

4 5

5