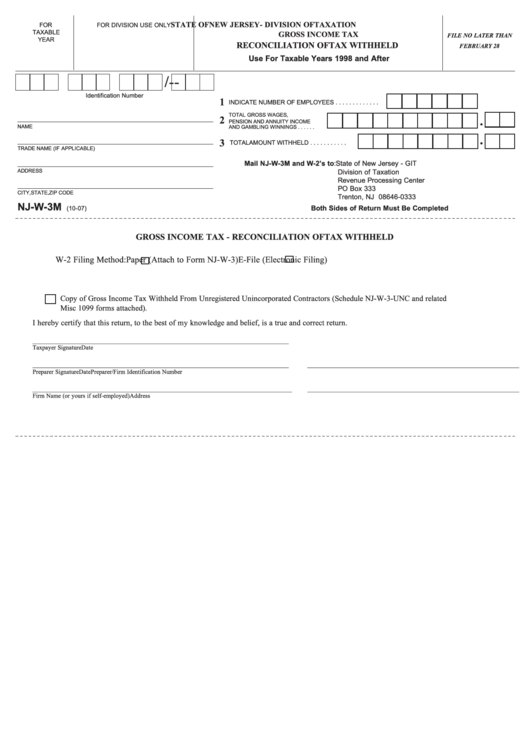

STATE OF NEW JERSEY - DIVISION OF TAXATION

FOR

FOR DIVISION USE ONLY

TAXABLE

GROSS INCOME TAX

FILE NO LATER THAN

YEAR

RECONCILIATION OF TAX WITHHELD

FEBRUARY 28

Use For Taxable Years 1998 and After

-

-

/

Identification Number

1

INDICATE NUMBER OF EMPLOYEES . . . . . . . . . . . . .

TOTAL GROSS WAGES,

2

___________________________________________________________________

PENSION AND ANNUITY INCOME

•

NAME

AND GAMBLING WINNINGS . . . . . .

___________________________________________________________________

3

•

TOTAL AMOUNT WITHHELD . . . . . . . . . . .

TRADE NAME (IF APPLICABLE)

Mail NJ-W-3M and W-2’s to: State of New Jersey - GIT

___________________________________________________________________

ADDRESS

Division of Taxation

Revenue Processing Center

___________________________________________________________________

PO Box 333

CITY,

STATE,

ZIP CODE

Trenton, NJ 08646-0333

NJ-W-3M

Both Sides of Return Must Be Completed

(10-07)

GROSS INCOME TAX - RECONCILIATION OF TAX WITHHELD

W-2 Filing Method:

Paper (Attach to Form NJ-W-3)

E-File (Electronic Filing)

Copy of Gross Income Tax Withheld From Unregistered Unincorporated Contractors (Schedule NJ-W-3-UNC and related

Misc 1099 forms attached).

I hereby certify that this return, to the best of my knowledge and belief, is a true and correct return.

_________________________________________________________________________________

Taxpayer Signature

Date

_________________________________________________________________________________

___________________________________________________________________

Preparer Signature

Date

Preparer/Firm Identification Number

__________________________________________________________________________________

___________________________________________________________________

Firm Name (or yours if self-employed)

Address

1

1