Form Ct-3-C - Consolidated Franchise Tax Return - New York State Department Of Taxation And Finance - 2012

ADVERTISEMENT

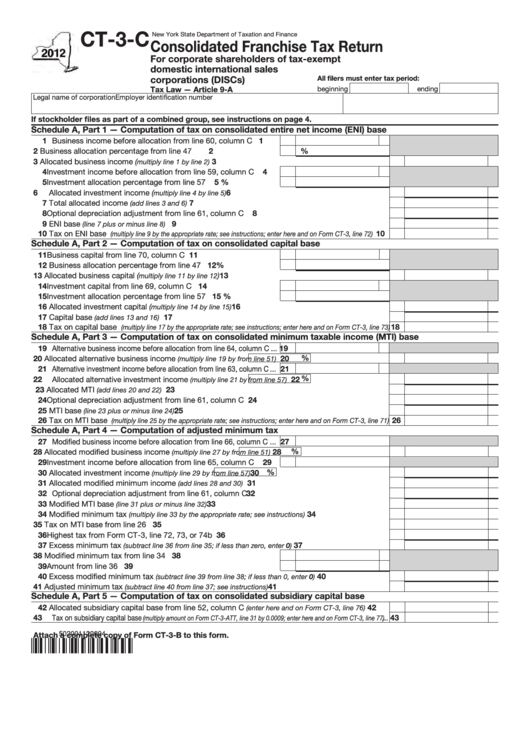

CT-3-C

New York State Department of Taxation and Finance

Consolidated Franchise Tax Return

For corporate shareholders of tax-exempt

domestic international sales

corporations (DISCs)

All filers must enter tax period:

beginning

ending

Tax Law — Article 9-A

Legal name of corporation

Employer identification number

If stockholder files as part of a combined group, see instructions on page 4.

Schedule A, Part 1 — Computation of tax on consolidated entire net income (ENI) base

1 Business income before allocation from line 60, column C ..........

1

2 Business allocation percentage from line 47 ................................

2

%

3 Allocated business income (

...........................................................................

3

multiply line 1 by line 2)

4 Investment income before allocation from line 59, column C .......

4

5 Investment allocation percentage from line 57 .............................

5

%

6 Allocated investment income (

6

........................................................................

multiply line 4 by line 5)

7 Total allocated income

..........................................................................................

7

(add lines 3 and 6)

8 Optional depreciation adjustment from line 61, column C ...............................................................

8

9 ENI base

9

....................................................................................................

(line 7 plus or minus line 8)

10 Tax on ENI base

...... 10

(multiply line 9 by the appropriate rate; see instructions; enter here and on Form CT-3, line 72)

Schedule A, Part 2 — Computation of tax on consolidated capital base

11 Business capital from line 70, column C ....................................... 11

12 Business allocation percentage from line 47 ................................. 12

%

13 Allocated business capital (

) ......................................................................... 13

multiply line 11 by line 12

14 Investment capital from line 69, column C .................................... 14

15 Investment allocation percentage from line 57 .............................. 15

%

16 Allocated investment capital (

...................................................................... 16

multiply line 14 by line 15)

17 Capital base

....................................................................................................... 17

(add lines 13 and 16)

18 Tax on capital base

18

(multiply line 17 by the appropriate rate; see instructions; enter here and on Form CT-3, line 73)

Schedule A, Part 3 — Computation of tax on consolidated minimum taxable income (MTI) base

19 Alternative business income before allocation from line 64, column C ... 19

%

20 Allocated alternative business income

............... 20

(multiply line 19 by

from line 51)

21 Alternative investment income before allocation from line 63, column C ... 21

%

22 Allocated alternative investment income

............... 22

(multiply line 21 by

from line 57)

23 Allocated MTI

.................................................................................................... 23

(add lines 20 and 22)

24 Optional depreciation adjustment from line 61, column C ............................................................... 24

25 MTI base

................................................................................................ 25

(line 23 plus or minus line 24)

26 Tax on MTI base

26

(multiply line 25 by the appropriate rate; see instructions; enter here and on Form CT-3, line 71)

Schedule A, Part 4 — Computation of adjusted minimum tax

27 Modified business income before allocation from line 66, column C ... 27

%

28 Allocated modified business income

.................... 28

(multiply line 27 by

from line 51)

29 Investment income before allocation from line 65, column C ....... 29

%

30 Allocated investment income

............................... 30

(multiply line 29 by

from line 57)

31 Allocated modified minimum income

................................................................ 31

(add lines 28 and 30)

32 Optional depreciation adjustment from line 61, column C ................................................................ 32

33 Modified MTI base

................................................................................. 33

(line 31 plus or minus line 32)

34 Modified minimum tax

..................................... 34

(multiply line 33 by the appropriate rate; see instructions)

35 Tax on MTI base from line 26 ........................................................................................................... 35

36 Highest tax from Form CT-3, line 72, 73, or 74b .............................................................................. 36

37 Excess minimum tax

.......................................... 37

(subtract line 36 from line 35; if less than zero, enter 0)

38 Modified minimum tax from line 34 ............................................... 38

39 Amount from line 36 ...................................................................... 39

40 Excess modified minimum tax

................................ 40

(subtract line 39 from line 38; if less than 0, enter 0)

41 Adjusted minimum tax

.................................................... 41

(subtract line 40 from line 37; see instructions)

Schedule A, Part 5 — Computation of tax on consolidated subsidiary capital base

42 Allocated subsidiary capital base from line 52, column C

......... 42

(enter here and on Form CT-3, line 76)

43 Tax on subsidiary capital base

... 43

(multiply amount on Form CT-3-ATT, line 31 by 0.0009; enter here and on Form CT-3, line 77)

Attach a complete copy of Form CT-3-B to this form.

502001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4