Form Rpd-41358 - Cancer Clinical Trial Tax Credit Claim Form - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

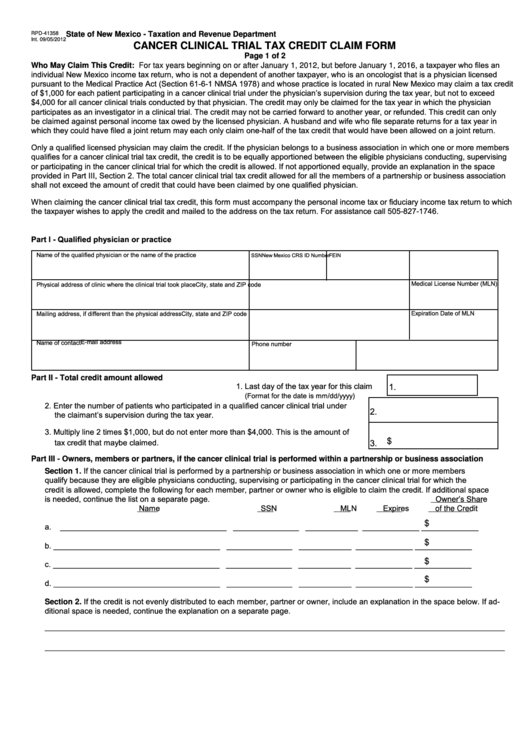

RPD-41358

State of New Mexico - Taxation and Revenue Department

Int. 09/05/2012

CANCER CLINICAL TRIAL TAX CREDIT CLAIM FORM

Page 1 of 2

Who May Claim This Credit: For tax years beginning on or after January 1, 2012, but before January 1, 2016, a taxpayer who files an

individual New Mexico income tax return, who is not a dependent of another taxpayer, who is an oncologist that is a physician licensed

pursuant to the Medical Practice Act (Section 61-6-1 NMSA 1978) and whose practice is located in rural New Mexico may claim a tax credit

of $1,000 for each patient participating in a cancer clinical trial under the physician’s supervision during the tax year, but not to exceed

$4,000 for all cancer clinical trials conducted by that physician. The credit may only be claimed for the tax year in which the physician

participates as an investigator in a clinical trial. The credit may not be carried forward to another year, or refunded. This credit can only

be claimed against personal income tax owed by the licensed physician. A husband and wife who file separate returns for a tax year in

which they could have filed a joint return may each only claim one-half of the tax credit that would have been allowed on a joint return.

Only a qualified licensed physician may claim the credit. If the physician belongs to a business association in which one or more members

qualifies for a cancer clinical trial tax credit, the credit is to be equally apportioned between the eligible physicians conducting, supervising

or participating in the cancer clinical trial for which the credit is allowed. If not apportioned equally, provide an explanation in the space

provided in Part III, Section 2. The total cancer clinical trial tax credit allowed for all the members of a partnership or business association

shall not exceed the amount of credit that could have been claimed by one qualified physician.

When claiming the cancer clinical trial tax credit, this form must accompany the personal income tax or fiduciary income tax return to which

the taxpayer wishes to apply the credit and mailed to the address on the tax return. For assistance call 505-827-1746.

Part I - Qualified physician or practice

Name of the qualified physician or the name of the practice

SSN

FEIN

New Mexico CRS ID Number

Medical License Number (MLN)

Physical address of clinic where the clinical trial took place

City, state and ZIP code

Expiration Date of MLN

Mailing address, if different than the physical address

City, state and ZIP code

Phone number

E-mail address

Name of contact

Part II - Total credit amount allowed

1. Last day of the tax year for this claim

1.

(Format for the date is mm/dd/yyyy)

2. Enter the number of patients who participated in a qualified cancer clinical trial under

2.

the claimant’s supervision during the tax year. ...............................................................

3. Multiply line 2 times $1,000, but do not enter more than $4,000. This is the amount of

$

tax credit that maybe claimed. .........................................................................................

3.

Part III - Owners, members or partners, if the cancer clinical trial is performed within a partnership or business association

Section 1. If the cancer clinical trial is performed by a partnership or business association in which one or more members

qualify because they are eligible physicians conducting, supervising or participating in the cancer clinical trial for which the

credit is allowed, complete the following for each member, partner or owner who is eligible to claim the credit. If additional space

is needed, continue the list on a separate page.

Owner’s Share

Name

SSN

MLN

Expires

of the Credit

$

a.

______________________________________ _______________ ____________ _____________ _____________

$

b.

______________________________________ _______________ ____________ _____________ _____________

$

c.

______________________________________ _______________ ____________ _____________ _____________

$

d.

______________________________________ _______________ ____________ _____________ _____________

Section 2. If the credit is not evenly distributed to each member, partner or owner, include an explanation in the space below. If ad-

ditional space is needed, continue the explanation on a separate page.

________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3