Form Rpd-41282 - Land Conservation Incentives Tax Credit Claim Form - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

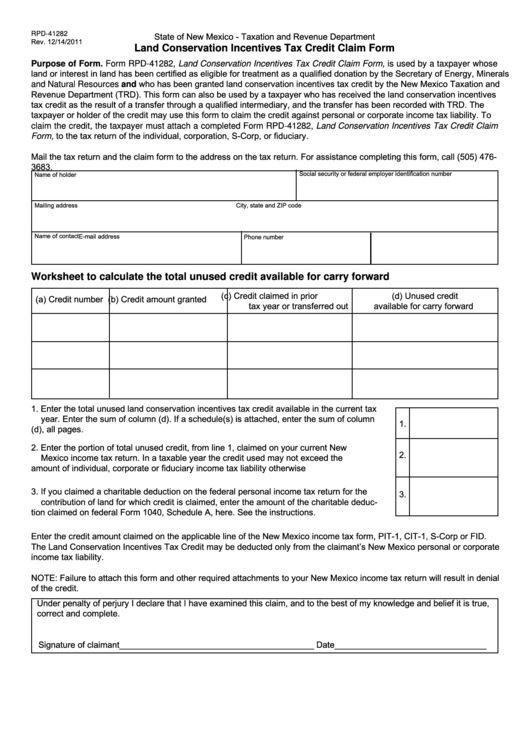

RPD-41282

State of New Mexico - Taxation and Revenue Department

Rev. 12/14/2011

Land Conservation Incentives Tax Credit Claim Form

Purpose of Form. Form RPD-41282, Land Conservation Incentives Tax Credit Claim Form, is used by a taxpayer whose

land or interest in land has been certified as eligible for treatment as a qualified donation by the Secretary of Energy, Minerals

and Natural Resources and who has been granted land conservation incentives tax credit by the New Mexico Taxation and

Revenue Department (TRD). This form can also be used by a taxpayer who has received the land conservation incentives

tax credit as the result of a transfer through a qualified intermediary, and the transfer has been recorded with TRD. The

taxpayer or holder of the credit may use this form to claim the credit against personal or corporate income tax liability. To

claim the credit, the taxpayer must attach a completed Form RPD-41282, Land Conservation Incentives Tax Credit Claim

Form, to the tax return of the individual, corporation, S-Corp, or fiduciary.

Mail the tax return and the claim form to the address on the tax return. For assistance completing this form, call (505) 476-

3683.

Social security or federal employer identification number

Name of holder

Mailing address

City, state and ZIP code

Name of contact

E-mail address

Phone number

Worksheet to calculate the total unused credit available for carry forward

(d) Unused credit

(c) Credit claimed in prior

(a) Credit number

(b) Credit amount granted

tax year or transferred out

available for carry forward

1. Enter the total unused land conservation incentives tax credit available in the current tax

year. Enter the sum of column (d). If a schedule(s) is attached, enter the sum of column

1.

(d), all pages. ..........................................................................................................................

2. Enter the portion of total unused credit, from line 1, claimed on your current New

2.

Mexico income tax return. In a taxable year the credit used may not exceed the

amount of individual, corporate or fiduciary income tax liability otherwise due......................

3. If you claimed a charitable deduction on the federal personal income tax return for the

3.

contribution of land for which credit is claimed, enter the amount of the charitable deduc-

tion claimed on federal Form 1040, Schedule A, here. See the instructions. ........................

Enter the credit amount claimed on the applicable line of the New Mexico income tax form, PIT-1, CIT-1, S-Corp or FID.

The Land Conservation Incentives Tax Credit may be deducted only from the claimant’s New Mexico personal or corporate

income tax liability.

NOTE: Failure to attach this form and other required attachments to your New Mexico income tax return will result in denial

of the credit.

Under penalty of perjury I declare that I have examined this claim, and to the best of my knowledge and belief it is true,

correct and complete.

Signature of claimant_________________________________________ Date________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1