Instructions For Form C-8020 - Michigan Sbt Penalty And Interest Computation For Underpaid Estimate Tax

ADVERTISEMENT

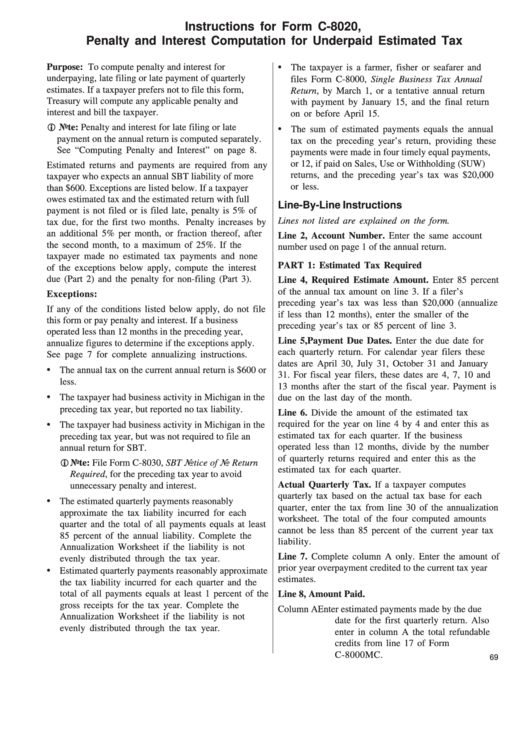

Instructions for Form C-8020,

Penalty and Interest Computation for Underpaid Estimated Tax

Purpose: To compute penalty and interest for

•

The taxpayer is a farmer, fisher or seafarer and

underpaying, late filing or late payment of quarterly

files Form C-8000, Single Business Tax Annual

estimates. If a taxpayer prefers not to file this form,

Return, by March 1, or a tentative annual return

Treasury will compute any applicable penalty and

with payment by January 15, and the final return

interest and bill the taxpayer.

on or before April 15.

Note: Penalty and interest for late filing or late

•

The sum of estimated payments equals the annual

payment on the annual return is computed separately.

tax on the preceding year’s return, providing these

See “Computing Penalty and Interest” on page 8.

payments were made in four timely equal payments,

or 12, if paid on Sales, Use or Withholding (SUW)

Estimated returns and payments are required from any

returns, and the preceding year’s tax was $20,000

taxpayer who expects an annual SBT liability of more

or less.

than $600. Exceptions are listed below. If a taxpayer

owes estimated tax and the estimated return with full

Line-By-Line Instructions

payment is not filed or is filed late, penalty is 5% of

Lines not listed are explained on the form.

tax due, for the first two months. Penalty increases by

an additional 5% per month, or fraction thereof, after

Line 2, Account Number. Enter the same account

the second month, to a maximum of 25%. If the

number used on page 1 of the annual return.

taxpayer made no estimated tax payments and none

PART 1: Estimated Tax Required

of the exceptions below apply, compute the interest

due (Part 2) and the penalty for non-filing (Part 3).

Line 4, Required Estimate Amount. Enter 85 percent

of the annual tax amount on line 3. If a filer’s

Exceptions:

preceding year’s tax was less than $20,000 (annualize

If any of the conditions listed below apply, do not file

if less than 12 months), enter the smaller of the

this form or pay penalty and interest. If a business

preceding year’s tax or 85 percent of line 3.

operated less than 12 months in the preceding year,

Line 5, Payment Due Dates. Enter the due date for

annualize figures to determine if the exceptions apply.

each quarterly return. For calendar year filers these

See page 7 for complete annualizing instructions.

dates are April 30, July 31, October 31 and January

•

The annual tax on the current annual return is $600 or

31. For fiscal year filers, these dates are 4, 7, 10 and

less.

13 months after the start of the fiscal year. Payment is

•

The taxpayer had business activity in Michigan in the

due on the last day of the month.

preceding tax year, but reported no tax liability.

Line 6. Divide the amount of the estimated tax

•

required for the year on line 4 by 4 and enter this as

The taxpayer had business activity in Michigan in the

estimated tax for each quarter. If the business

preceding tax year, but was not required to file an

operated less than 12 months, divide by the number

annual return for SBT.

of quarterly returns required and enter this as the

Note: File Form C-8030, SBT Notice of No Return

estimated tax for each quarter.

Required, for the preceding tax year to avoid

Actual Quarterly Tax. If a taxpayer computes

unnecessary penalty and interest.

quarterly tax based on the actual tax base for each

•

The estimated quarterly payments reasonably

quarter, enter the tax from line 30 of the annualization

approximate the tax liability incurred for each

worksheet. The total of the four computed amounts

quarter and the total of all payments equals at least

cannot be less than 85 percent of the current year tax

85 percent of the annual liability. Complete the

liability.

Annualization Worksheet if the liability is not

Line 7. Complete column A only. Enter the amount of

evenly distributed through the tax year.

prior year overpayment credited to the current tax year

•

Estimated quarterly payments reasonably approximate

estimates.

the tax liability incurred for each quarter and the

total of all payments equals at least 1 percent of the

Line 8, Amount Paid.

gross receipts for the tax year. Complete the

Column A

Enter estimated payments made by the due

Annualization Worksheet if the liability is not

date for the first quarterly return. Also

evenly distributed through the tax year.

enter in column A the total refundable

credits from line 17 of Form

C-8000MC.

69

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2