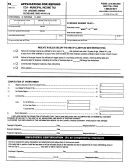

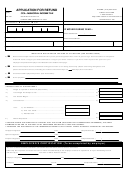

Instructions For Cca Form 120-18 Page 2

ADVERTISEMENT

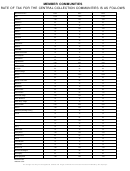

MEMBER COMMUNITIES

RATE OF TAX FOR THE CENTRAL COLLECTION COMMUNITIES IS AS FOLLOWS

MUNICIPALITY

2003

2004

2005

Ada

1.15%

1.15%

1.15%

Andover

1.5%

1.5%

1.5%

Barberton

2%

2%

2%

Bradner

1%

1%

1%

Bratenahl

1.5%

1.5%

1.5%

Burton

1%

1%

1%

Chardon

1%

1%

2%

Cleveland

2%

2%

2%

Creston

1%

1%

1%

Cridersville

0

1%*

1%

Dunkirk

1%

1%

1%

Gates Mills

1%

1%

1%

Geneva-on-the-Lake

1%

1%

1%

Grand Rapids

1%

1%

1%

Grand River

2%

2%

2%

Highland Hills

2.5%

2.5%

2.5%

Liberty Center

1%

1%

1%

Linndale

2%

2%

2%

Madison Village

1%

1%

1%

Medina

.5%

1.25%

1.25%

Mentor

2%

2%

2%

Mentor-on-the-Lake

2%

2%

2%

Metamora

1%

1%

1%

Middlefield

1%

1%

1%

Munroe Falls

2%

2%

2%

New Franklin

0%

0%

1%**

Northfield Village

1.5%

1.5%

2%

North Baltimore

1%

1%

1%

North Perry Village

1%

1%

1%

North Randall

2.5%

2.5%

2.5%

Norton

1.5%

1.5%

2%

Oakwood (Paulding County)

1%

1%

1%

Orwell

1%

1%

1%

Painesville

2%

2%

2%

Paulding

.5%

.5%

.5%

Peninsula

1%

1%

1%

Perry

1%

1%

1%

Rock Creek

1%

1%

1%

Rocky River

1.5%

1.5%

1.5%

Russells Point

0%

0%

1%

Seville

1%

1%

1%

South Russell

1%

1%

1%

Timberlake

1%

1%

1%

Wadsworth

1.3%

1.3%

1.3%

Warrensville Heights

2%

2%

2%

Willoughby

2%

2%

2%

Willoughby Hills

1.5%

1.5%

1.5%

*Effective 4/1/04

**Effective 9/1/05

An average rate may not be applied to salaries and wages on which the correct tax has been withheld by the employer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2