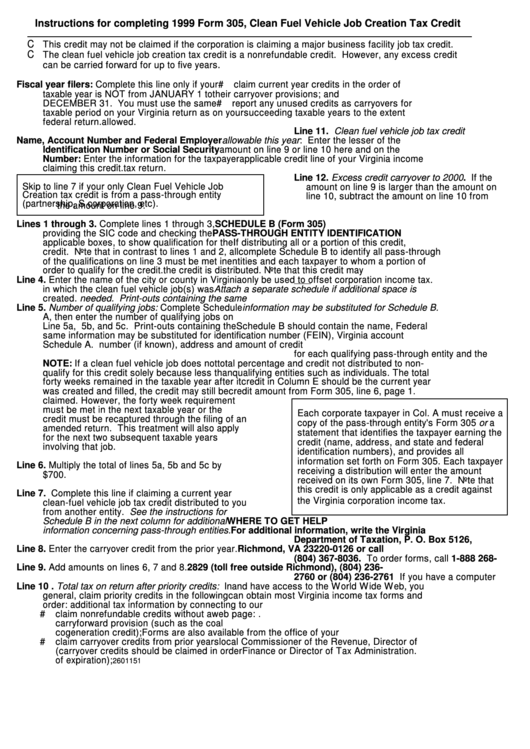

Instructions For Completing 1999 Form 305, Clean Fuel Vehicle Job Creation Tax Credit

ADVERTISEMENT

Instructions for completing 1999 Form 305, Clean Fuel Vehicle Job Creation Tax Credit

C

This credit may not be claimed if the corporation is claiming a major business facility job tax credit.

C

The clean fuel vehicle job creation tax credit is a nonrefundable credit. However, any excess credit

can be carried forward for up to five years.

#

Fiscal year filers: Complete this line only if your

claim current year credits in the order of

taxable year is NOT from JANUARY 1 to

their carryover provisions; and

#

DECEMBER 31. You must use the same

report any unused credits as carryovers for

taxable period on your Virginia return as on your

succeeding taxable years to the extent

federal return.

allowed.

Line 11. Clean fuel vehicle job tax credit

Name, Account Number and Federal Employer

allowable this year: Enter the lesser of the

Identification Number or Social Security

amount on line 9 or line 10 here and on the

Number: Enter the information for the taxpayer

applicable credit line of your Virginia income

claiming this credit.

tax return.

Line 12. Excess credit carryover to 2000. If the

Skip to line 7 if your only Clean Fuel Vehicle Job

amount on line 9 is larger than the amount on

Creation tax credit is from a pass-through entity

line 10, subtract the amount on line 10 from

(partnership, S corporation, etc).

the amount on line 9.

Lines 1 through 3. Complete lines 1 through 3,

SCHEDULE B (Form 305)

providing the SIC code and checking the

PASS-THROUGH ENTITY IDENTIFICATION

applicable boxes, to show qualification for the

If distributing all or a portion of this credit,

credit. Note that in contrast to lines 1 and 2, all

complete Schedule B to identify all pass-through

of the qualifications on line 3 must be met in

entities and each taxpayer to whom a portion of

order to qualify for the credit.

the credit is distributed. Note that this credit may

Line 4. Enter the name of the city or county in Virginia

only be used to offset corporation income tax.

in which the clean fuel vehicle job(s) was

Attach a separate schedule if additional space is

created.

needed. Print-outs containing the same

Line 5. Number of qualifying jobs: Complete Schedule

information may be substituted for Schedule B.

A, then enter the number of qualifying jobs on

Line 5a, 5b, and 5c. Print-outs containing the

Schedule B should contain the name, Federal

same information may be substituted for

identification number (FEIN), Virginia account

Schedule A.

number (if known), address and amount of credit

for each qualifying pass-through entity and the

NOTE: If a clean fuel vehicle job does not

total percentage and credit not distributed to non-

qualify for this credit solely because less than

qualifying entities such as individuals. The total

forty weeks remained in the taxable year after it

credit in Column E should be the current year

was created and filled, the credit may still be

credit amount from Form 305, line 6, page 1.

claimed. However, the forty week requirement

must be met in the next taxable year or the

Each corporate taxpayer in Col. A must receive a

credit must be recaptured through the filing of an

copy of the pass-through entity's Form 305 or a

amended return. This treatment will also apply

statement that identifies the taxpayer earning the

for the next two subsequent taxable years

credit (name, address, and state and federal

involving that job.

identification numbers), and provides all

information set forth on Form 305. Each taxpayer

Line 6. Multiply the total of lines 5a, 5b and 5c by

receiving a distribution will enter the amount

$700.

received on its own Form 305, line 7. Note that

this credit is only applicable as a credit against

Line 7. Complete this line if claiming a current year

.

the Virginia corporation income tax

clean-fuel vehicle job tax credit distributed to you

from another entity. See the instructions for

Schedule B in the next column for additional

WHERE TO GET HELP

information concerning pass-through entities.

For additional information, write the Virginia

Department of Taxation, P. O. Box 5126,

Line 8. Enter the carryover credit from the prior year.

Richmond, VA 23220-0126 or call

(804) 367-8036. To order forms, call 1-888 268-

Line 9. Add amounts on lines 6, 7 and 8.

2829 (toll free outside Richmond), (804) 236-

2760 or (804) 236-2761 If you have a computer

Line 10 . Total tax on return after priority credits: In

and have access to the World Wide Web, you

general, claim priority credits in the following

can obtain most Virginia income tax forms and

order:

additional tax information by connecting to our

#

claim nonrefundable credits without a

web page:

carryforward provision (such as the coal

cogeneration credit);

Forms are also available from the office of your

#

claim carryover credits from prior years

local Commissioner of the Revenue, Director of

(carryover credits should be claimed in order

Finance or Director of Tax Administration.

of expiration);

2601151

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1