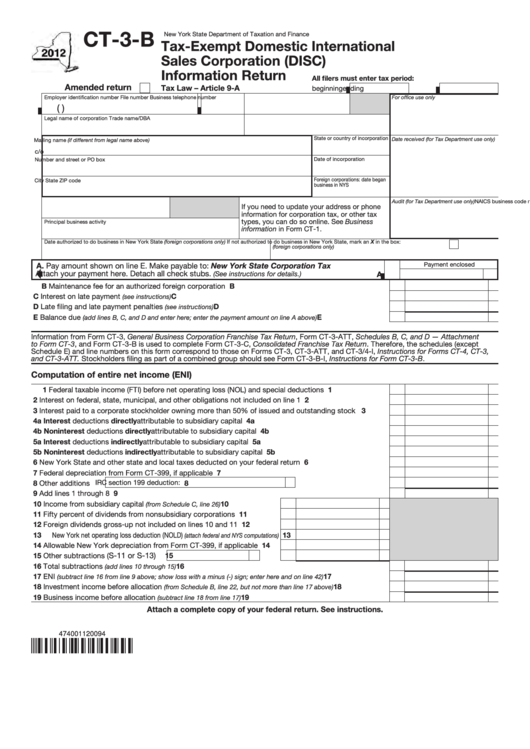

Form Ct-3-B - Tax-Exempt Domestic International Sales Corporation (Disc) Information Return - 2012

ADVERTISEMENT

CT-3-B

New York State Department of Taxation and Finance

Tax-Exempt Domestic International

Sales Corporation (DISC)

Information Return

All filers must enter tax period:

Amended return

Tax Law – Article 9-A

beginning

ending

Employer identification number

File number

Business telephone number

For office use only

(

)

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

Audit (for Tax Department use only)

(from federal return)

If you need to update your address or phone

information for corporation tax, or other tax

types, you can do so online. See Business

Principal business activity

information in Form CT-1.

Date authorized to do business in New York State (foreign corporations only)

If not authorized to do business in New York State, mark an X in the box:

(foreign corporations only)

A. Pay amount shown on line E. Make payable to: New York State Corporation Tax

Payment enclosed

Attach your payment here. Detach all check stubs.

(See instructions for details.)

A

B Maintenance fee for an authorized foreign corporation ............................................................................

B

C Interest on late payment

..................................................................................................

C

(see instructions)

D Late filing and late payment penalties

.............................................................................

D

(see instructions)

E Balance due

E

..........................

(add lines B, C, and D and enter here; enter the payment amount on line A above)

Information from Form CT-3, General Business Corporation Franchise Tax Return, Form CT-3-ATT, Schedules B, C, and D — Attachment

to Form CT-3, and Form CT-3-B is used to complete Form CT-3-C, Consolidated Franchise Tax Return. Therefore, the schedules (except

Schedule E) and line numbers on this form correspond to those on Forms CT-3, CT-3-ATT, and CT-3/4-I, Instructions for Forms CT-4, CT-3,

and CT-3-ATT. Stockholders filing as part of a combined group should see Form CT-3-B-I, Instructions for Form CT-3-B.

Computation of entire net income (ENI)

1 Federal taxable income (FTI) before net operating loss (NOL) and special deductions ...........................

1

2 Interest on federal, state, municipal, and other obligations not included on line 1 ..................................

2

3 Interest paid to a corporate stockholder owning more than 50% of issued and outstanding stock .......

3

4a Interest deductions directly attributable to subsidiary capital ................................................................

4a

4b Noninterest deductions directly attributable to subsidiary capital .........................................................

4b

5a Interest deductions indirectly attributable to subsidiary capital .............................................................

5a

5b Noninterest deductions indirectly attributable to subsidiary capital ......................................................

5b

6 New York State and other state and local taxes deducted on your federal return ...................................

6

7 Federal depreciation from Form CT-399, if applicable ..............................................................................

7

IRC section 199 deduction:

8 Other additions

...........................................

8

9 Add lines 1 through 8 ................................................................................................................................

9

10 Income from subsidiary capital

......................

10

(from Schedule C, line 26)

11 Fifty percent of dividends from nonsubsidiary corporations ................

11

12 Foreign dividends gross-up not included on lines 10 and 11 ..............

12

13 New York net operating loss deduction (NOLD)

13

(attach federal and NYS computations)

14 Allowable New York depreciation from Form CT-399, if applicable .....

14

15 Other subtractions (

S-11 or S-13)

15

.......

16 Total subtractions

.................................................................................................

16

(add lines 10 through 15)

17 ENI

.........................

17

(subtract line 16 from line 9 above; show loss with a minus (-) sign; enter here and on line 42)

18 Investment income before allocation

18

...................

(from Schedule B, line 22, but not more than line 17 above)

19 Business income before allocation

19

.................................................................

(subtract line 18 from line 17)

Attach a complete copy of your federal return. See instructions.

474001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6