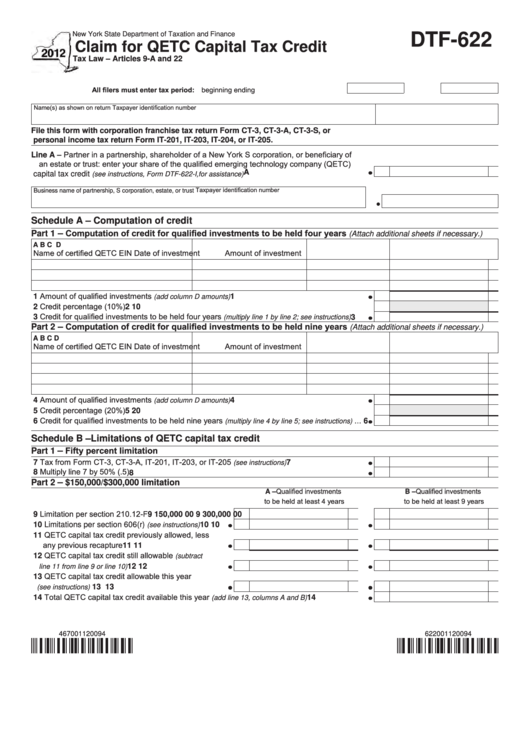

New York State Department of Taxation and Finance

DTF-622

Claim for QETC Capital Tax Credit

Tax Law – Articles 9-A and 22

All filers must enter tax period: beginning

ending

Name(s) as shown on return

Taxpayer identification number

File this form with corporation franchise tax return Form CT-3, CT-3-A, CT-3-S, or

personal income tax return Form IT-201, IT-203, IT-204, or IT-205.

Line A – Partner in a partnership, shareholder of a New York S corporation, or beneficiary of

an estate or trust: enter your share of the qualified emerging technology company (QETC)

A

capital tax credit

.....................................................

(see instructions, Form DTF-622-I, for assistance)

Taxpayer identification number

Business name of partnership, S corporation, estate, or trust

Schedule A – Computation of credit

Computation of credit for qualified investments to be held four years

–

Part 1

(Attach additional sheets if necessary.)

A

B

C

D

Name of certified QETC

EIN

Date of investment

Amount of investment

1 Amount of qualified investments

...........................................................

1

(add column D amounts)

2 Credit percentage (10%) .............................................................................................................

2

10

3 Credit for qualified investments to be held four years

....

(multiply line 1 by line 2; see instructions)

3

Computation of credit for qualified investments to be held nine years

–

Part 2

(Attach additional sheets if necessary.)

A

B

C

D

Name of certified QETC

EIN

Date of investment

Amount of investment

4 Amount of qualified investments

...........................................................

4

(add column D amounts)

5 Credit percentage (20%) .............................................................................................................

5

20

6 Credit for qualified investments to be held nine years

...

6

(multiply line 4 by line 5; see instructions)

Schedule B – Limitations of QETC capital tax credit

Fifty percent limitation

–

Part 1

7 Tax from Form CT‑3, CT‑3‑A, IT‑201, IT‑203, or IT‑205

...................................

7

(see instructions)

8 Multiply line 7 by 50% (.5) .........................................................................................................

8

–

Part 2

$150,000/$300,000 limitation

A – Qualified investments

B – Qualified investments

to be held at least 4 years

to be held at least 9 years

9 Limitation per section 210.12‑F ..................................

9

150,000 00

9

300,000 00

10 Limitations per section 606(r)

..........

10

10

(see instructions)

11 QETC capital tax credit previously allowed, less

any previous recapture .........................................

11

11

12 QETC capital tax credit still allowable

(subtract

......................................

12

12

line 11 from line 9 or line 10)

13 QETC capital tax credit allowable this year

......................................................

13

13

(see instructions)

14 Total QETC capital tax credit available this year

...........................

14

(add line 13, columns A and B)

467001120094

622001120094

1

1 2

2