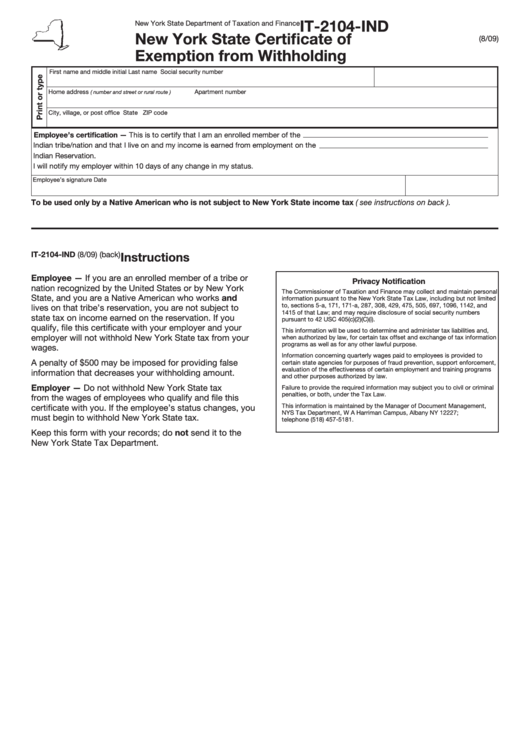

IT-2104-IND

New York State Department of Taxation and Finance

New York State Certificate of

(8/09)

Exemption from Withholding

First name and middle initial

Last name

Social security number

Home address

Apartment number

( number and street or rural route )

City, village, or post office

State

ZIP code

Employee’s certification — This is to certify that I am an enrolled member of the

Indian tribe/nation and that I live on and my income is earned from employment on the

Indian Reservation.

I will notify my employer within 10 days of any change in my status.

Employee’s signature

Date

To be used only by a Native American who is not subject to New York State income tax ( see instructions on back ).

IT-2104-IND (8/09) (back)

Instructions

Employee — If you are an enrolled member of a tribe or

Privacy Notification

nation recognized by the United States or by New York

The Commissioner of Taxation and Finance may collect and maintain personal

State, and you are a Native American who works and

information pursuant to the New York State Tax Law, including but not limited

to, sections 5-a, 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and

lives on that tribe’s reservation, you are not subject to

1415 of that Law; and may require disclosure of social security numbers

state tax on income earned on the reservation. If you

pursuant to 42 USC 405(c)(2)(C)(i).

qualify, file this certificate with your employer and your

This information will be used to determine and administer tax liabilities and,

employer will not withhold New York State tax from your

when authorized by law, for certain tax offset and exchange of tax information

programs as well as for any other lawful purpose.

wages.

Information concerning quarterly wages paid to employees is provided to

A penalty of $500 may be imposed for providing false

certain state agencies for purposes of fraud prevention, support enforcement,

evaluation of the effectiveness of certain employment and training programs

information that decreases your withholding amount.

and other purposes authorized by law.

Employer — Do not withhold New York State tax

Failure to provide the required information may subject you to civil or criminal

penalties, or both, under the Tax Law.

from the wages of employees who qualify and file this

This information is maintained by the Manager of Document Management,

certificate with you. If the employee’s status changes, you

NYS Tax Department, W A Harriman Campus, Albany NY 12227;

must begin to withhold New York State tax.

telephone (518) 457-5181.

Keep this form with your records; do not send it to the

New York State Tax Department.

1

1