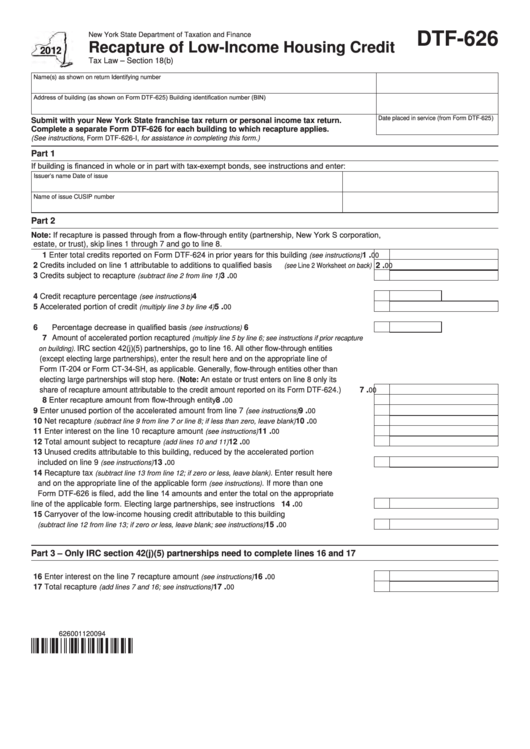

DTF-626

New York State Department of Taxation and Finance

Recapture of Low-Income Housing Credit

Tax Law – Section 18(b)

Name(s) as shown on return

Identifying number

Address of building (as shown on Form DTF-625)

Building identification number (BIN)

Date placed in service (from Form DTF-625)

Submit with your New York State franchise tax return or personal income tax return.

Complete a separate Form DTF-626 for each building to which recapture applies.

(See instructions, Form DTF-626-I, for assistance in completing this form.)

Part 1

If building is financed in whole or in part with tax-exempt bonds, see instructions and enter:

Issuer’s name

Date of issue

Name of issue

CUSIP number

Part 2

Note: If recapture is passed through from a flow-through entity (partnership, New York S corporation,

estate, or trust), skip lines 1 through 7 and go to line 8.

.

1 Enter total credits reported on Form DTF-624 in prior years for this building

1

(see instructions)

00

2 Credits included on line 1 attributable to additions to qualified basis

.

2

(see Line 2 Worksheet on back)

00

.

3 Credits subject to recapture

................................................................

3

(subtract line 2 from line 1)

00

4 Credit recapture percentage

............................................................................

4

(see instructions)

.

5 Accelerated portion of credit

..................................................................

5

(multiply line 3 by line 4)

00

6 Percentage decrease in qualified basis

...........................................................

6

(see instructions)

7 Amount of accelerated portion recaptured

(multiply line 5 by line 6; see instructions if prior recapture

IRC section 42(j)(5) partnerships, go to line 16. All other flow-through entities

on building).

(except electing large partnerships), enter the result here and on the appropriate line of

Form IT-204 or Form CT-34-SH, as applicable. Generally, flow-through entities other than

electing large partnerships will stop here. (Note: An estate or trust enters on line 8 only its

.

share of recapture amount attributable to the credit amount reported on its Form DTF-624.) .....

7

00

8 Enter recapture amount from flow-through entity.......................................................................

.

8

00

.

9 Enter unused portion of the accelerated amount from line 7 (

...........................

9

see instructions)

00

.

10 Net recapture

............................... 10

(subtract line 9 from line 7 or line 8; if less than zero, leave blank)

00

.

11 Enter interest on the line 10 recapture amount

................................................ 11

(see instructions)

00

.

12 Total amount subject to recapture

.............................................................. 12

(add lines 10 and 11)

00

13 Unused credits attributable to this building, reduced by the accelerated portion

.

included on line 9

.......................................................................................... 13

(see instructions)

00

14 Recapture tax

Enter result here

(subtract line 13 from line 12; if zero or less, leave blank).

and on the appropriate line of the applicable form

. If more than one

(see instructions)

Form DTF-626 is filed, add the line 14 amounts and enter the total on the appropriate

.

line of the applicable form. Electing large partnerships, see instructions .............................. 14

00

15 Carryover of the low-income housing credit attributable to this building

.

....................................... 15

(subtract line 12 from line 13; if zero or less, leave blank; see instructions)

00

Part 3 – Only IRC section 42(j)(5) partnerships need to complete lines 16 and 17

.

16 Enter interest on the line 7 recapture amount

................................................. 16

(see instructions)

00

.

17 Total recapture

..................................................................... 17

(add lines 7 and 16; see instructions)

00

626001120094

1

1 2

2