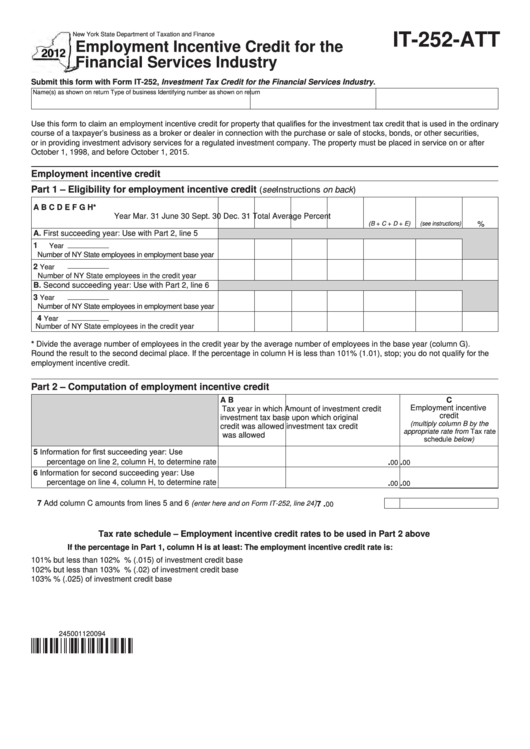

New York State Department of Taxation and Finance

IT-252-ATT

Employment Incentive Credit for the

Financial Services Industry

Submit this form with Form IT-252, Investment Tax Credit for the Financial Services Industry.

Name(s) as shown on return

Type of business

Identifying number as shown on return

Use this form to claim an employment incentive credit for property that qualifies for the investment tax credit that is used in the ordinary

course of a taxpayer’s business as a broker or dealer in connection with the purchase or sale of stocks, bonds, or other securities,

or in providing investment advisory services for a regulated investment company. The property must be placed in service on or after

October 1, 1998, and before October 1, 2015.

Employment incentive credit

Part 1 – Eligibility for employment incentive credit

(see Instructions on back)

A

B

C

D

E

F

G

H*

Year

Mar. 31

June 30 Sept. 30

Dec. 31

Total

Average

Percent

%

(B + C + D + E)

(see instructions)

A. First succeeding year: Use with Part 2, line 5

1

Year

Number of NY State employees in employment base year

2

Year

Number of NY State employees in the credit year

B. Second succeeding year: Use with Part 2, line 6

3

Year

Number of NY State employees in employment base year

4

Year

Number of NY State employees in the credit year

* Divide the average number of employees in the credit year by the average number of employees in the base year (column G).

Round the result to the second decimal place. If the percentage in column H is less than 101% (1.01), stop; you do not qualify for the

employment incentive credit.

Part 2 – Computation of employment incentive credit

A

B

C

Employment incentive

Tax year in which

Amount of investment credit

credit

investment tax

base upon which original

(multiply column B by the

credit was allowed

investment tax credit

appropriate rate from Tax rate

was allowed

schedule below)

5 Information for first succeeding year: Use

percentage on line 2, column H, to determine rate

.

.

00

00

6 Information for second succeeding year: Use

percentage on line 4, column H, to determine rate

.

.

00

00

7 Add column C amounts from lines 5 and 6 (

) .............................

.

enter here and on Form IT-252, line 24

7

00

Tax rate schedule – Employment incentive credit rates to be used in Part 2 above

If the percentage in Part 1, column H is at least:

The employment incentive credit rate is:

101% but less than 102% ..................................................................... 1½% (.015) of investment credit base

102% but less than 103% ..................................................................... 2% (.02) of investment credit base

103%..................................................................................................... 2½% (.025) of investment credit base

245001120094

1

1 2

2