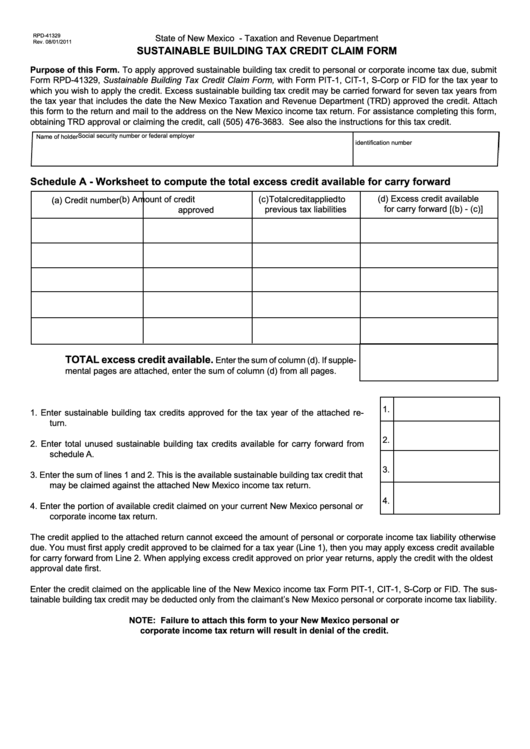

Form Rpd-41329 - Sustainable Building Tax Credit Claim Form

ADVERTISEMENT

RPD-41329

State of New Mexico - Taxation and Revenue Department

Rev. 08/01/2011

SUSTAINABLE BUILDING TAX CREDIT CLAIM FORM

Purpose of this Form. To apply approved sustainable building tax credit to personal or corporate income tax due, submit

Form RPD-41329, Sustainable Building Tax Credit Claim Form, with Form PIT-1, CIT-1, S-Corp or FID for the tax year to

which you wish to apply the credit. Excess sustainable building tax credit may be carried forward for seven tax years from

the tax year that includes the date the New Mexico Taxation and Revenue Department (TRD) approved the credit. Attach

this form to the return and mail to the address on the New Mexico income tax return. For assistance completing this form,

obtaining TRD approval or claiming the credit, call (505) 476-3683. See also the instructions for this tax credit.

Social security number or federal employer

Name of holder

identification number

Schedule A - Worksheet to compute the total excess credit available for carry forward

(d) Excess credit available

(b) Amount of credit

(c) Total credit applied to

(a) Credit number

for carry forward [(b) - (c)]

previous tax liabilities

approved

TOTAL excess credit available.

Enter the sum of column (d). If supple-

mental pages are attached, enter the sum of column (d) from all pages.

1.

1.

Enter sustainable building tax credits approved for the tax year of the attached re-

turn.

2.

2.

Enter total unused sustainable building tax credits available for carry forward from

schedule A.

3.

3.

Enter the sum of lines 1 and 2. This is the available sustainable building tax credit that

may be claimed against the attached New Mexico income tax return.

4.

4.

Enter the portion of available credit claimed on your current New Mexico personal or

corporate income tax return.

The credit applied to the attached return cannot exceed the amount of personal or corporate income tax liability otherwise

due. You must first apply credit approved to be claimed for a tax year (Line 1), then you may apply excess credit available

for carry forward from Line 2. When applying excess credit approved on prior year returns, apply the credit with the oldest

approval date first.

Enter the credit claimed on the applicable line of the New Mexico income tax Form PIT-1, CIT-1, S-Corp or FID. The sus-

tainable building tax credit may be deducted only from the claimant’s New Mexico personal or corporate income tax liability.

NOTE: Failure to attach this form to your New Mexico personal or

corporate income tax return will result in denial of the credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1