Form Ct-41 - Claim For Credit For Employment Of Persons With Disabilities - 2011

ADVERTISEMENT

Staple forms here

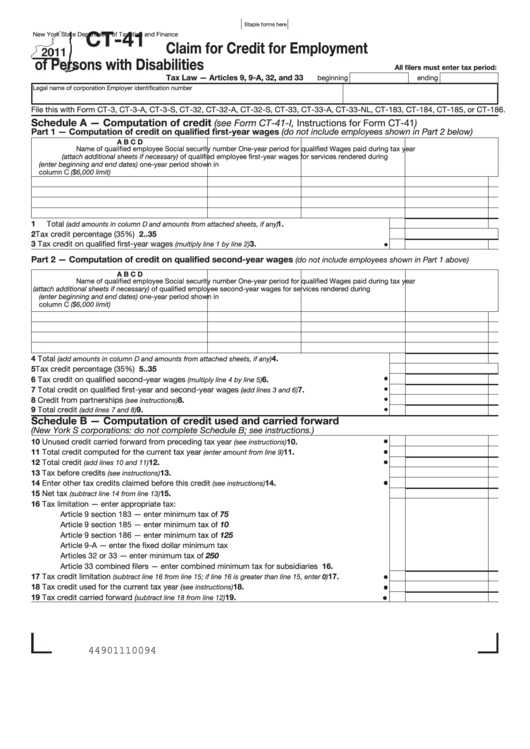

CT-41

New York State Department of Taxation and Finance

Claim for Credit for Employment

of Persons with Disabilities

All filers must enter tax period:

Tax Law — Articles 9, 9-A, 32, and 33

beginning

ending

Legal name of corporation

Employer identification number

File this with Form CT-3, CT-3-A, CT-3-S, CT-32, CT-32-A, CT-32-S, CT-33, CT-33-A, CT-33-NL, CT-183, CT-184, CT-185, or CT-186.

Schedule A — Computation of credit

(see Form CT‑41‑I, Instructions for Form CT-41)

Part 1 — Computation of credit on qualified first-year wages (do not include employees shown in Part 2 below)

A

B

C

D

Name of qualified employee

Social security number

One-year period for qualified

Wages paid during tax year

(attach additional sheets if necessary)

of qualified employee

first-year wages

for services rendered during

(enter beginning and end dates)

one-year period shown in

column C ($6,000 limit)

1

Total

..................................................

1.

(add amounts in column D and amounts from attached sheets, if any)

2

2.

.35

Tax credit percentage (35%) ...............................................................................................................

3

Tax credit on qualified first-year wages

.........................................................

3.

(multiply line 1 by line 2)

Part 2 — Computation of credit on qualified second-year wages

(do not include employees shown in Part 1 above)

A

B

C

D

Name of qualified employee

Social security number

One-year period for qualified

Wages paid during tax year

(attach additional sheets if necessary)

of qualified employee

second-year wages

for services rendered during

(enter beginning and end dates)

one-year period shown in

column C ($6,000 limit)

4

4.

Total

.................................................

(add amounts in column D and amounts from attached sheets, if any)

5

Tax credit percentage (35%) ...............................................................................................................

5.

.35

6

Tax credit on qualified second-year wages

...................................................

6.

(multiply line 4 by line 5)

7

Total credit on qualified first-year and second-year wages

...................................

7.

(add lines 3 and 6)

8

Credit from partnerships

..........................................................................................

8.

(see instructions)

9

Total credit

.............................................................................................................

9.

(add lines 7 and 8)

Schedule B — Computation of credit used and carried forward

(New York S corporations: do not complete Schedule B; see instructions.)

10 Unused credit carried forward from preceding tax year

..........................................

10.

(see instructions)

11 Total credit computed for the current tax year

............................................

11.

(enter amount from line 9)

12 Total credit

12.

..........................................................................................................

(add lines 10 and 11)

13 Tax before credits

...................................................................................................... 13.

(see instructions)

14 Enter other tax credits claimed before this credit

....................................................

14.

(see instructions)

15 Net tax

...................................................................................................... 15.

(subtract line 14 from line 13)

16 Tax limitation — enter appropriate tax:

Article 9 section 183 — enter minimum tax of 75

Article 9 section 185 — enter minimum tax of 10

Article 9 section 186 — enter minimum tax of 125

Article 9-A — enter the fixed dollar minimum tax

Articles 32 or 33 — enter minimum tax of 250

Article 33 combined filers — enter combined minimum tax for subsidiaries ............................... 16.

17 Tax credit limitation

17.

........................

(subtract line 16 from line 15; if line 16 is greater than line 15, enter 0)

18 Tax credit used for the current tax year (

18.

...................................................................

see instructions)

19 Tax credit carried forward (

.......................................................................

19.

subtract line 18 from line 12)

44901110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2