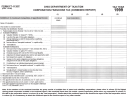

FT 1120C

Rev. 6/11

Page 2

(1)

(2)

(3)

(4)

(5)

Schedule D (Combined)

Combined

Apportionment Ratio

Lead Corporation

Totals

Name of corporation

Ending date of taxable year

1. Property – Ohio (a) Owned (average cost)........................................

(b) Rented (annual rental x 8) .................................

(c) Total Ohio ..........................................................

2. Property – everywhere (a) Owned (average cost)..............................

(b) Rented (annual rental x 8) .......................

(c) Total everywhere ......................................

3. Payroll – Ohio .....................................................................................

4. Payroll – everywhere ..........................................................................

5. Sales – Ohio .......................................................................................

6. Less intercorporate sales ...................................................................

7. Net Ohio sales ....................................................................................

8. Sales – everywhere ............................................................................

9. Less intercorporate sales ...................................................................

10. Net everywhere sales .........................................................................

Ratios (carry to six decimal places)

.

.

.

.

11. Property (line 1(c), each column, divided by line 2(c), column 1) .......

.

.

.

.

12. Payroll (line 3, each column, divided by line 4, column 1) ..................

.

.

.

.

13. Sales (line 7, each column, divided by line 10, column 1) ..................

Weighted Apportionment Ratio

.

.

.

.

14. Property (multiply line 11, each column, by .20) .................................

.

.

.

.

15. Payroll (multiply line 12, each column, by .20) ...................................

.

.

.

.

16. Sales (multiply line 13, each column, by .60) .....................................

17. Weighted apportionment ratio. Add the weighted ratios on lines

.

.

.

.

14, 15 and 16, each column. Enter each column on Schedule B

.

(combined), line 6 and Schedule B-3 (combined), line 8 ....................

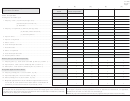

Note 1: If the denominator of any factor (column (1), lines 2(c), 4 or 10) is zero, the weight given to the

Note 2: For purposes of determining each taxpayer’s net value of stock on the net worth basis, use

other factors must be proportionately increased so that the total weight given to the combined number

the taxpayer’s separate company apportionment ratio as determined on Schedule D, or if applicable,

of factors used is 100%. Each taxpayer’s apportionment ratio as determined on Schedule D (combined)

Schedule D-2, Ohio form FT 1120. See R.C. 5733.05(C)(3).

applies only to the taxpayer’s net income basis.

Note 3: Any request for deviation from the statutory apportionment provisions must be in writing.

1

1 2

2 3

3 4

4 5

5 6

6