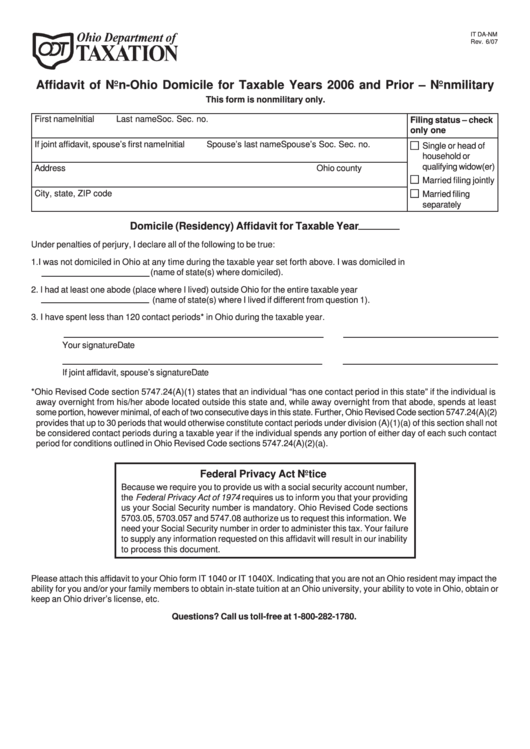

IT DA-NM

Rev. 6/07

Reset Form

Affidavit of Non-Ohio Domicile for Taxable Years 2006 and Prior – Nonmilitary

This form is nonmilitary only.

First name

Initial

Last name

Soc. Sec. no.

Filing status – check

only one

If joint affidavit, spouse’s first name

Initial

Spouse’s last name

Spouse’s Soc. Sec. no.

Single or head of

household or

qualifying widow(er)

Address

Ohio county

Married filing jointly

City, state, ZIP code

Married filing

separately

Domicile (Residency) Affidavit for Taxable Year

Under penalties of perjury, I declare all of the following to be true:

1. I was not domiciled in Ohio at any time during the taxable year set forth above. I was domiciled in

(name of state(s) where domiciled).

2. I had at least one abode (place where I lived) outside Ohio for the entire taxable year

(name of state(s) where I lived if different from question 1).

3. I have spent less than 120 contact periods* in Ohio during the taxable year.

Your signature

Date

If joint affidavit, spouse’s signature

Date

* Ohio Revised Code section 5747.24(A)(1) states that an individual “has one contact period in this state” if the individual is

away overnight from his/her abode located outside this state and, while away overnight from that abode, spends at least

some portion, however minimal, of each of two consecutive days in this state. Further, Ohio Revised Code section 5747.24(A)(2)

provides that up to 30 periods that would otherwise constitute contact periods under division (A)(1)(a) of this section shall not

be considered contact periods during a taxable year if the individual spends any portion of either day of each such contact

period for conditions outlined in Ohio Revised Code sections 5747.24(A)(2)(a).

Federal Privacy Act Notice

Because we require you to provide us with a social security account number,

the Federal Privacy Act of 1974 requires us to inform you that your providing

us your Social Security number is mandatory. Ohio Revised Code sections

5703.05, 5703.057 and 5747.08 authorize us to request this information. We

need your Social Security number in order to administer this tax. Your failure

to supply any information requested on this affidavit will result in our inability

to process this document.

Please attach this affidavit to your Ohio form IT 1040 or IT 1040X. Indicating that you are not an Ohio resident may impact the

ability for you and/or your family members to obtain in-state tuition at an Ohio university, your ability to vote in Ohio, obtain or

keep an Ohio driver’s license, etc.

Questions? Call us toll-free at 1-800-282-1780.

1

1