Reset Form

hio

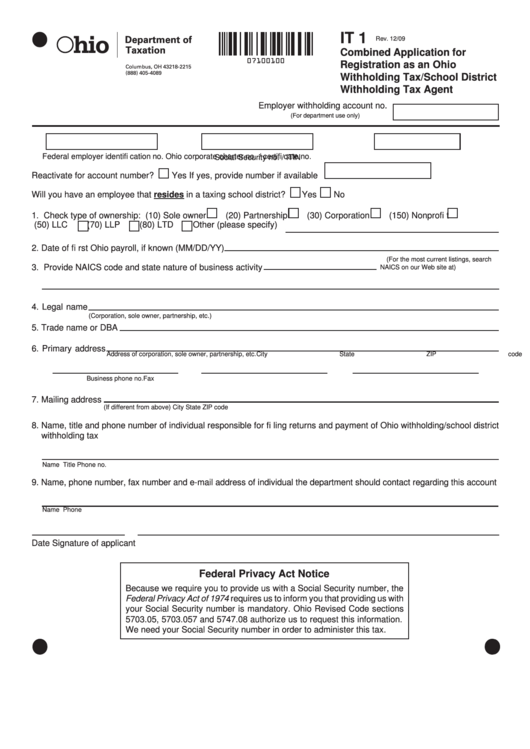

IT 1

Department of

Rev. 12/09

Taxation

Combined Application for

07100100

P .O. Box 182215

Registration as an Ohio

Columbus, OH 43218-2215

(888) 405-4089

Withholding Tax/School District

Withholding Tax Agent

Employer withholding account no.

(For department use only)

Federal employer identifi cation no.

Ohio corporate charter no. / certifi cate no.

Social Security no. / ITIN

Reactivate for account number? Yes If yes, provide number if available

Yes

Will you have an employee that resides in a taxing school district?

No

1. Check type of ownership: (10) Sole owner

(20) Partnership

(30) Corporation

(150) Nonprofi t

(50) LLC

(70) LLP

(80) LTD

Other (please specify)

2. Date of fi rst Ohio payroll, if known (MM/DD/YY)

(For the most current listings, search

3. Provide NAICS code and state nature of business activity

NAICS on our Web site at tax.ohio.gov.)

4. Legal name

(Corporation, sole owner, partnership, etc.)

5. Trade name or DBA

6. Primary address

Address of corporation, sole owner, partnership, etc.

City

State

ZIP code

Business phone no.

Fax no.

Secondary phone no.

7. Mailing address

(If different from above)

City

State

ZIP code

8. Name, title and phone number of individual responsible for fi ling returns and payment of Ohio withholding/school district

withholding tax

Name

Title

Phone no.

9. Name, phone number, fax number and e-mail address of individual the department should contact regarding this account

Name

Phone no.

Fax no.

E-mail address

Date

Signature of applicant

Federal Privacy Act Notice

Because we require you to provide us with a Social Security number, the

Federal Privacy Act of 1974 requires us to inform you that providing us with

your Social Security number is mandatory. Ohio Revised Code sections

5703.05, 5703.057 and 5747.08 authorize us to request this information.

We need your Social Security number in order to administer this tax.

1

1