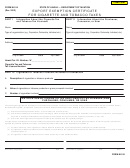

FORM M-104

INSTRUCTIONS

(Rev. 2008)

GENERAL INFORMATION

PURPOSE OF THIS

WHERE TO FILE THE

CERTIFICATE

CERTIFICATE

Section 245-32, Hawaii Revised

Statutes (HRS), provides for a cigarette

Form M-104, Export Exemption Cer-

The certificate must be attached to the

and tobacco tax refund or credit to a li-

tificate for Cigarette and Tobacco Taxes,

cigarette tax and tobacco tax licensee’s

censee who has paid a cigarette or to-

must be completed in order for the ciga-

Form M-19, Cigarette and Tobacco

bacco tax on the distribution of cigarettes

rette tax and tobacco tax licensee to

Products Monthly Tax Return, when

or tobacco products that are shipped to a

claim a (1) cigarette tax refund, or (2) to-

claiming a refund of cigarette taxes paid

point outside the State for subsequent

bacco tax exemption on the distribution

with cigarette tax stamps. The certificate

sale or use outside the State.

of cigarettes or tobacco products that are

does not need to be attached to Form

shipped to a point outside the State for

M-19 when claiming a tobacco tax ex-

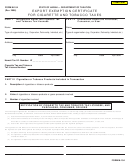

ADDITIONAL INFORMATION

subsequent sale or use outside the

emption. Instead, the certificate must be

Export and Foreign Cigarettes

State. Form M-104 must also be com-

retained at the cigarette tax and tobacco

Prohibited

pleted for sales made under section

tax licensee’s place of business.

212-8, HRS, to any common carrier for

WHERE TO GET INFORMATION

It is unlawful for an entity to possess,

consumption out-of-state by the crew or

keep, store, retain, transport, sell, or of-

passengers on such carrier, and for

Oahu District Office

fer to sell, distribute, acquire, hold, own,

sales by wholesalers from U.S. licensed

830 Punchbowl Street

import, or cause to be imported into the

bonded warehouses to foreign fishing

P. O. Box 259

State any of the cigarettes described in

vessels and to common carriers for

Honolulu, HI 96809-0259

section 245-51, HRS.

out-of-state consumption by the crew or

Tel. No.: (808) 587-4242

Stamping or Sale of Cigarettes

passengers. This form must be a part of

Toll Free: 1-800-222-3229

Not Listed in the Directory

each order or contract of sale between

Maui District Office

Prohibited

the cigarette tax and tobacco tax li-

54 S. High St., #208

censee; and purchaser, consumer, or

Beginning December 1, 2003, un-

Wailuku, HI 96793-2198

user who are signatories to the certifi-

less the cigarette package is exempted

Toll Free: 1-800-222-3229

cate. In the event Form M-104 is imprac-

under section 245-3(b), HRS, it is unlaw-

ticable to complete, an alternative form

Hawaii District Office

ful (a) to affix a cigarette tax stamp to any

or document may be used provided the

75 Aupuni St., #101

cigarette package whose tobacco prod-

information requested in Parts I, II, and III

Hilo, HI 96720-4245

uct manufacturer or brand family is not

of Form M-104 are maintained.

Toll Free: 1-800-222-3229

listed in the directory established under

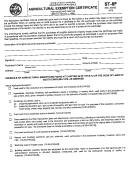

SPECIFIC INSTRUCTIONS

chapter 486P, HRS, or (b) to import, sell,

Kauai District Office

offer, keep, store, acquire, transport, dis-

3060 Eiwa St., #105

Part I

tribute, receive, or possess for sale or

Lihue, HI 96766-1889

distribution cigarettes of a tobacco prod-

Enter information regarding the cigarette

Toll Free: 1-800-222-3229

uct manufacturer or brand family not in-

tax and tobacco tax licensee.

cluded in the directory. Any violation will

Part II

be guilty of a class C felony.

Enter information regarding the pur-

To determine whether the cigarette

chaser, consumer, or user.

manufacturer or brand family is listed in

such directory, please visit the Tobacco

Part III

Enforcement Unit, Department of the At-

Enter information regarding the ciga-

torney General’s website at:

rettes or tobacco products involved in

this transaction.

The Tobacco Enforcement Unit also

SIGNING OF THE CERTIFICATE

may be contacted as follows:

The certificate shall be dated, executed,

Correspondence:

and signed by both the cigarette tax and

TOBACCO ENFORCEMENT UNIT

tobacco tax licensee; and the purchaser,

Department of the Attorney General

consumer, or user.

425 Queen Street

Honolulu, Hawaii 96813

Telephone: (808) 586-1203

1

1 2

2