F

47

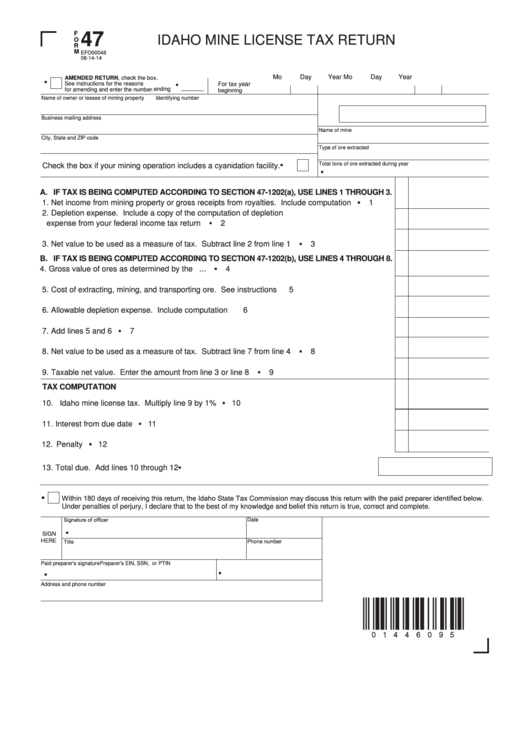

IDAHO MINE LICENSE TAX RETURN

O

R

M

EFO00048

08-14-14

Mo

Day

Year

Mo

Day

Year

AMENDED RETURN, check the box.

▪

▪

See instructions for the reasons

For tax year

ending

for amending and enter the number.

beginning

Name of owner or lessee of mining property

Identifying number

Business mailing address

Name of mine

City, State and ZIP code

Type of ore extracted

▪

Total tons of ore extracted during year

Check the box if your mining operation includes a cyanidation facility.

▪

A. IF TAX IS BEING COMPUTED ACCORDING TO SECTION 47-1202(a), USE LINES 1 THROUGH 3.

1. Net income from mining property or gross receipts from royalties. Include computation ........... ▪

1

2. Depletion expense. Include a copy of the computation of depletion

expense from your federal income tax return ............................................................................. ▪

2

3. Net value to be used as a measure of tax. Subtract line 2 from line 1 ....................................... ▪

3

B. IF TAX IS BEING COMPUTED ACCORDING TO SECTION 47-1202(b), USE LINES 4 THROUGH 8.

4. Gross value of ores as determined by the U.S. Department of Interior. Include computation ... ▪

4

5. Cost of extracting, mining, and transporting ore. See instructions .............................................

5

6. Allowable depletion expense. Include computation ....................................................................

6

7. Add lines 5 and 6 ......................................................................................................................... ▪

7

8. Net value to be used as a measure of tax. Subtract line 7 from line 4 ....................................... ▪

8

9. Taxable net value. Enter the amount from line 3 or line 8 .......................................................... ▪

9

TAX COMPUTATION

10. Idaho mine license tax. Multiply line 9 by 1% ............................................................................. ▪ 10

11. Interest from due date .................................................................................................................. ▪ 11

12. Penalty ......................................................................................................................................... ▪ 12

13. Total due. Add lines 10 through 12 ...................................................................................... ▪

.

Within 180 days of receiving this return, the Idaho State Tax Commission may discuss this return with the paid preparer identified below.

Under penalties of perjury, I declare that to the best of my knowledge and belief this return is true, correct and complete.

Signature of officer

Date

▪

SIGN

HERE

Title

Phone number

Paid preparer's signature

Preparer's EIN, SSN, or PTIN

▪

▪

Address and phone number

{"M]¦}

1

1 2

2