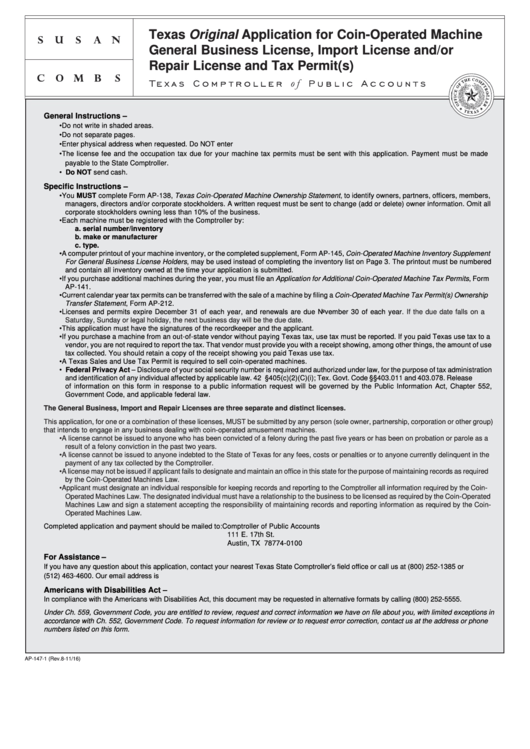

Texas Original Application for Coin-Operated Machine

General Business License, Import License and/or

Repair License and Tax Permit(s)

General Instructions –

• Do not write in shaded areas.

• Do not separate pages.

• Enter physical address when requested. Do NOT enter P.O. Box or rural route.

• The license fee and the occupation tax due for your machine tax permits must be sent with this application. Payment must be made

payable to the State Comptroller.

• Do NOT send cash.

Specific Instructions –

• You MUST complete Form AP-138, Texas Coin-Operated Machine Ownership Statement, to identify owners, partners, officers, members,

managers, directors and/or corporate stockholders. A written request must be sent to change (add or delete) owner information. Omit all

corporate stockholders owning less than 10% of the business.

• Each machine must be registered with the Comptroller by:

a. serial number/inventory I.D. number

b. make or manufacturer

c. type.

• A computer printout of your machine inventory, or the completed supplement, Form AP-145, Coin-Operated Machine Inventory Supplement

For General Business License Holders, may be used instead of completing the inventory list on Page 3. The printout must be numbered

and contain all inventory owned at the time your application is submitted.

• If you purchase additional machines during the year, you must file an Application for Additional Coin-Operated Machine Tax Permits, Form

AP-141.

• Current calendar year tax permits can be transferred with the sale of a machine by filing a Coin-Operated Machine Tax Permit(s) Ownership

Transfer Statement, Form AP-212.

• Licenses and permits expire December 31 of each year, and renewals are due November 30 of each year.

If the due date falls on a

Saturday, Sunday or legal holiday, the next business day will be the due date.

• This application must have the signatures of the recordkeeper and the applicant.

• If you purchase a machine from an out-of-state vendor without paying Texas tax, use tax must be reported. If you paid Texas use tax to a

vendor, you are not required to report the tax. That vendor must provide you with a receipt showing, among other things, the amount of use

tax collected. You should retain a copy of the receipt showing you paid Texas use tax.

• A Texas Sales and Use Tax Permit is required to sell coin-operated machines.

• Federal Privacy Act – Disclosure of your social security number is required and authorized under law, for the purpose of tax administration

and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release

of information on this form in response to a public information request will be governed by the Public Information Act, Chapter 552,

Government Code, and applicable federal law.

The General Business, Import and Repair Licenses are three separate and distinct licenses.

This application, for one or a combination of these licenses, MUST be submitted by any person (sole owner, partnership, corporation or other group)

that intends to engage in any business dealing with coin-operated amusement machines.

• A license cannot be issued to anyone who has been convicted of a felony during the past five years or has been on probation or parole as a

result of a felony conviction in the past two years.

• A license cannot be issued to anyone indebted to the State of Texas for any fees, costs or penalties or to anyone currently delinquent in the

payment of any tax collected by the Comptroller.

• A license may not be issued if applicant fails to designate and maintain an office in this state for the purpose of maintaining records as required

by the Coin-Operated Machines Law.

• Applicant must designate an individual responsible for keeping records and reporting to the Comptroller all information required by the Coin-

Operated Machines Law. The designated individual must have a relationship to the business to be licensed as required by the Coin-Operated

Machines Law and sign a statement accepting the responsibility of maintaining records and reporting information as required by the Coin-

Operated Machines Law.

Completed application and payment should be mailed to: Comptroller of Public Accounts

111 E. 17th St.

Austin, TX 78774-0100

For Assistance –

If you have any question about this application, contact your nearest Texas State Comptroller’s field office or call us at (800) 252-1385 or

(512) 463-4600. Our email address is tax.help@cpa.state.tx.us.

Americans with Disabilities Act –

In compliance with the Americans with Disabilities Act, this document may be requested in alternative formats by calling (800) 252-5555.

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in

accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or phone

numbers listed on this form.

AP-147-1 (Rev.8-11/16)

1

1 2

2 3

3 4

4 5

5 6

6