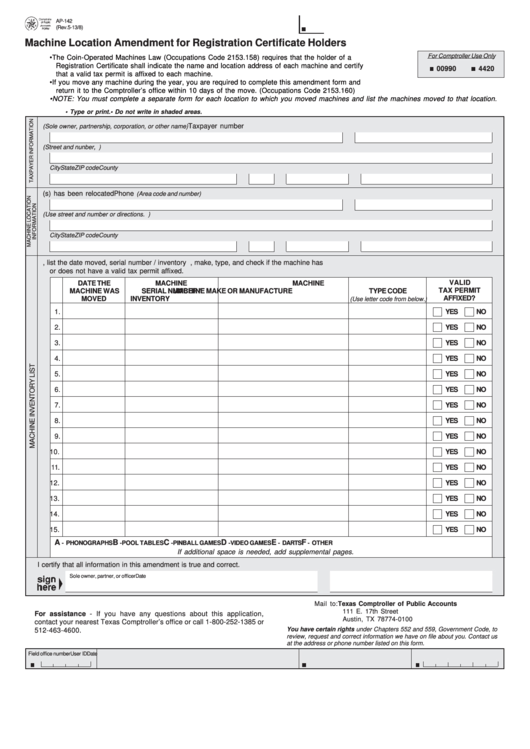

AP-142

PRINT FORM

CLEAR FIELDS

(Rev.5-13/8)

Machine Location Amendment for Registration Certificate Holders

For Comptroller Use Only

• The Coin-Operated Machines Law (Occupations Code 2153.158) requires that the holder of a

Registration Certificate shall indicate the name and location address of each machine and certify

00990

4420

that a valid tax permit is affixed to each machine.

• If you move any machine during the year, you are required to complete this amendment form and

return it to the Comptroller’s office within 10 days of the move. (Occupations Code 2153.160)

• NOTE: You must complete a separate form for each location to which you moved machines and list the machines moved to that location.

• Type or print.

• Do not write in shaded areas.

1. Legal name of owner

Taxpayer number

(Sole owner, partnership, corporation, or other name)

2. Mailing address

(Street and nunber, P.O. Box or Rural Route and box number)

City

State

ZIP code

County

3. Trade name of your business where machine(s) has been relocated

Phone

(Area code and number)

4. Location of this business

(Use street and number or directions. P.O. Box or Rural Route NOT acceptable)

City

State

ZIP code

County

5. For each machine moved to this location, list the date moved, serial number / inventory I.D. number, make, type, and check if the machine has

or does not have a valid tax permit affixed.

VALID

DATE THE

MACHINE

MACHINE

TAX PERMIT

MACHINE WAS

SERIAL NUMBER /

MACHINE MAKE OR MANUFACTURE

TYPE CODE

AFFIXED?

MOVED

INVENTORY I.D. NUMBER

(Use letter code from below.)

1.

YES

NO

2.

YES

NO

3.

YES

NO

4.

YES

NO

5.

YES

NO

6.

YES

NO

7.

YES

NO

8.

YES

NO

9.

YES

NO

10.

YES

NO

11.

YES

NO

12.

YES

NO

13.

YES

NO

14.

YES

NO

15.

YES

NO

A

B

C

D

E

F

- PHONOGRAPHS

- POOL TABLES

- PINBALL GAMES

- VIDEO GAMES

- DARTS

- OTHER

If additional space is needed, add supplemental pages.

I certify that all information in this amendment is true and correct.

Sole owner, partner, or officer

Date

Mail to: Texas Comptroller of Public Accounts

111 E. 17th Street

For assistance - If you have any questions about this application,

Austin, TX 78774-0100

contact your nearest Texas Comptroller’s office or call 1-800-252-1385 or

You have certain rights under Chapters 552 and 559, Government Code, to

512-463-4600.

review, request and correct information we have on file about you. Contact us

at the address or phone number listed on this form.

Field office number

E.O. name

User ID

Date

1

1