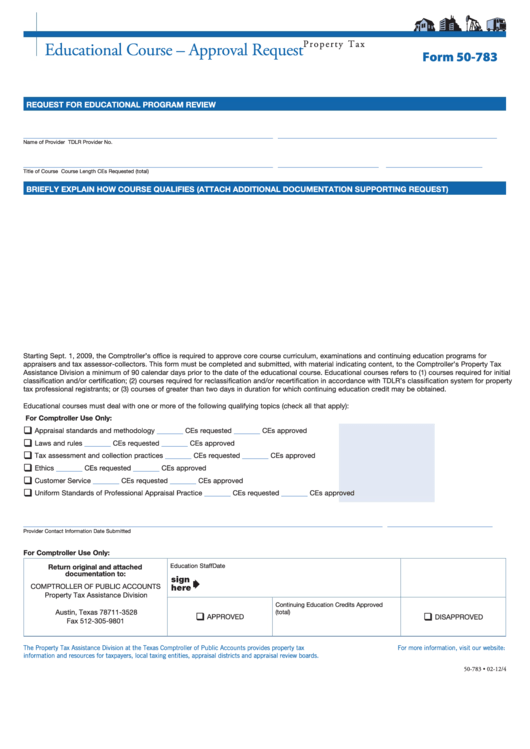

P r o p e r t y T a x

Educational Course – Approval Request

Form 50-783

REQUEST FOR EDUCATIONAL PROGRAM REVIEW

_________________________________________________________

__________________________________________________

Name of Provider

TDLR Provider No.

_________________________________________________________

_______________________

______________________

Title of Course

Course Length

CEs Requested (total)

BRIEFLY EXPLAIN HOW COURSE QUALIFIES (ATTACH ADDITIONAL DOCUMENTATION SUPPORTING REQUEST)

Starting Sept. 1, 2009, the Comptroller’s office is required to approve core course curriculum, examinations and continuing education programs for

appraisers and tax assessor-collectors. This form must be completed and submitted, with material indicating content, to the Comptroller’s Property Tax

Assistance Division a minimum of 90 calendar days prior to the date of the educational course. Educational courses refers to (1) courses required for initial

classification and/or certification; (2) courses required for reclassification and/or recertification in accordance with TDLR’s classification system for property

tax professional registrants; or (3) courses of greater than two days in duration for which continuing education credit may be obtained.

Educational courses must deal with one or more of the following qualifying topics (check all that apply):

For Comptroller Use Only:

______

______

Appraisal standards and methodology

CEs requested

CEs approved

______

______

Laws and rules

CEs requested

CEs approved

______

______

Tax assessment and collection practices

CEs requested

CEs approved

______

______

Ethics

CEs requested

CEs approved

______

______

Customer Service

CEs requested

CEs approved

______

______

Uniform Standards of Professional Appraisal Practice

CEs requested

CEs approved

__________________________________________________________________________________

________________________

Provider Contact Information

Date Submitted

For Comptroller Use Only:

Education Staff

Date

Return original and attached

documentation to:

COMPTROLLER OF PUBLIC ACCOUNTS

Property Tax Assistance Division

P.O. Box 13528

Continuing Education Credits Approved

Austin, Texas 78711-3528

(total)

APPROVED

DISAPPROVED

Fax 512-305-9801

ptad.cpa@cpa.state.tx.us

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-783 • 02-12/4

1

1